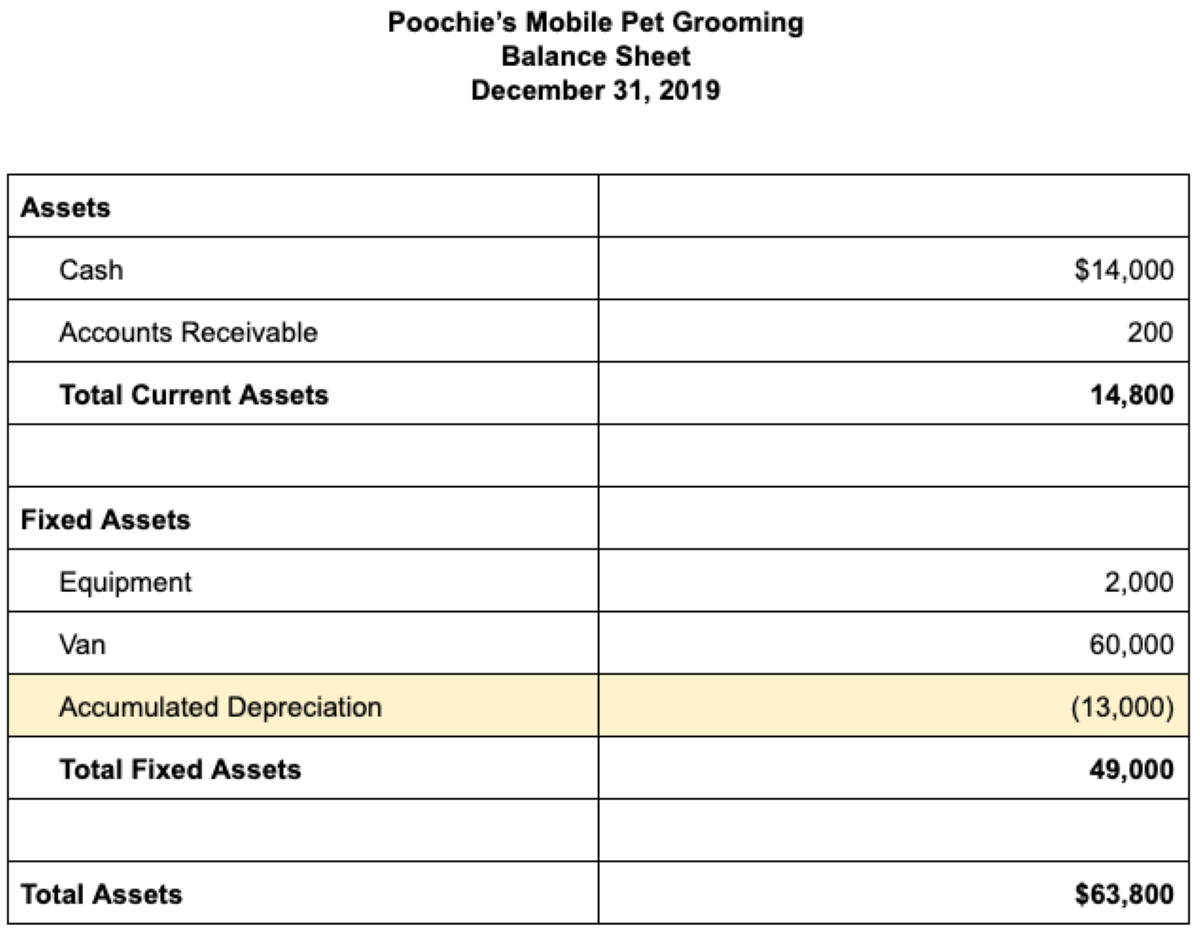

Where Does Depreciation Go On Balance Sheet - Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Accumulated depreciation is under fixed assets on a balance sheet. It's a credit balance deducted from the total cost of property, plant, and.

Accumulated depreciation is under fixed assets on a balance sheet. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. It's a credit balance deducted from the total cost of property, plant, and.

Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Accumulated depreciation is under fixed assets on a balance sheet. It's a credit balance deducted from the total cost of property, plant, and. Depreciation expense is an accounting method that allocates the cost of an asset over its useful life.

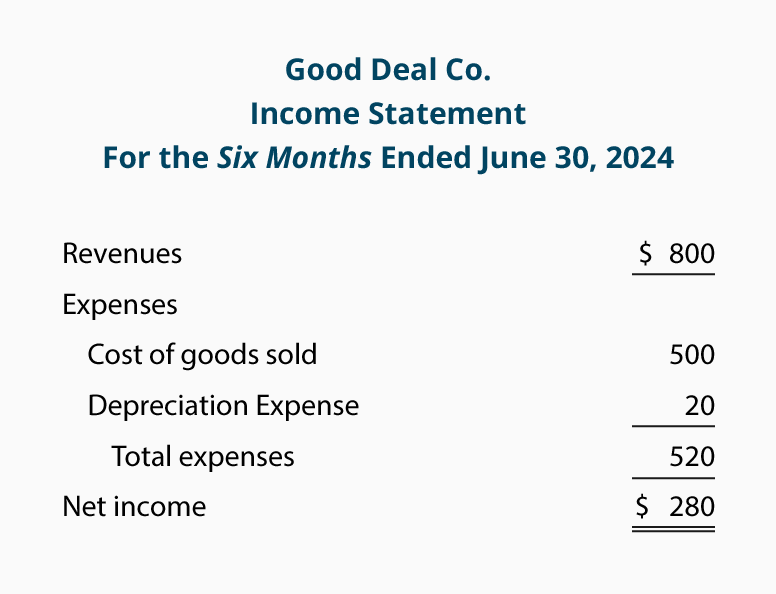

How do you account for depreciation on a balance sheet? Leia aqui Is

Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Accumulated depreciation is under fixed assets on a balance sheet. It's a credit balance deducted from the total cost of property, plant, and.

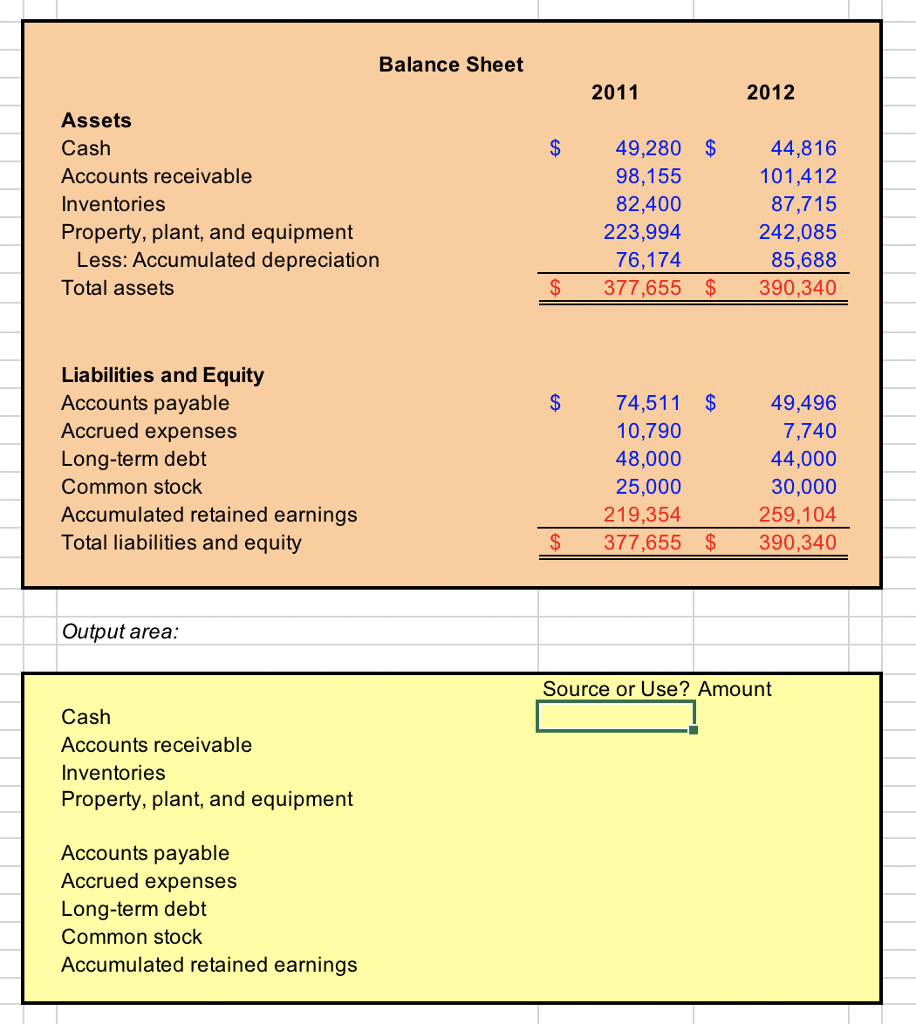

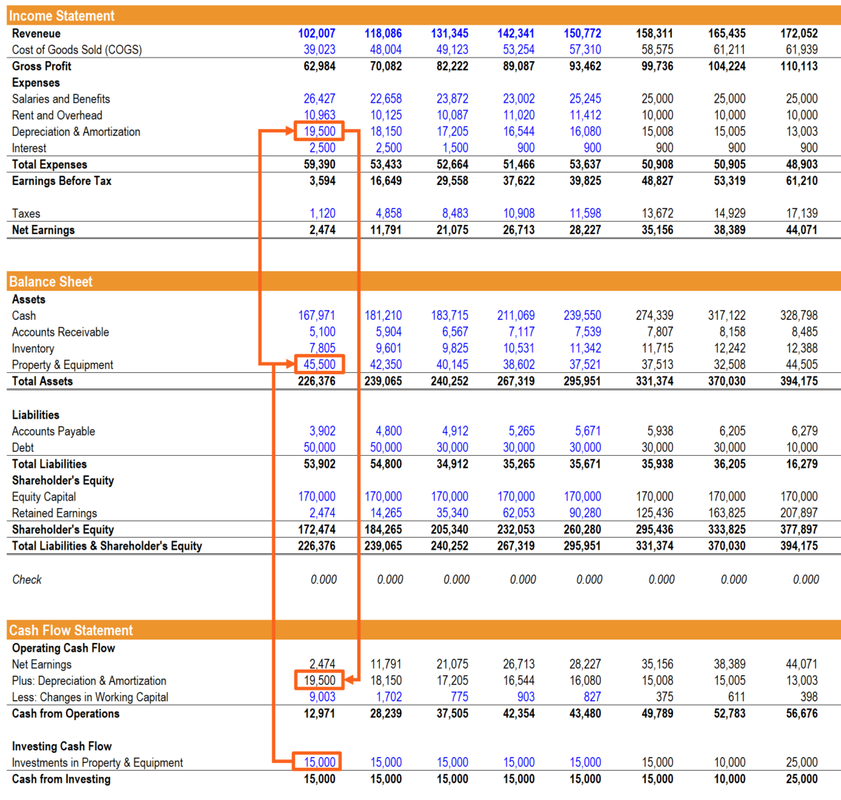

Depreciation And Accumulated Depreciation Expense

It's a credit balance deducted from the total cost of property, plant, and. Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. Accumulated depreciation is under fixed assets on a balance sheet. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account.

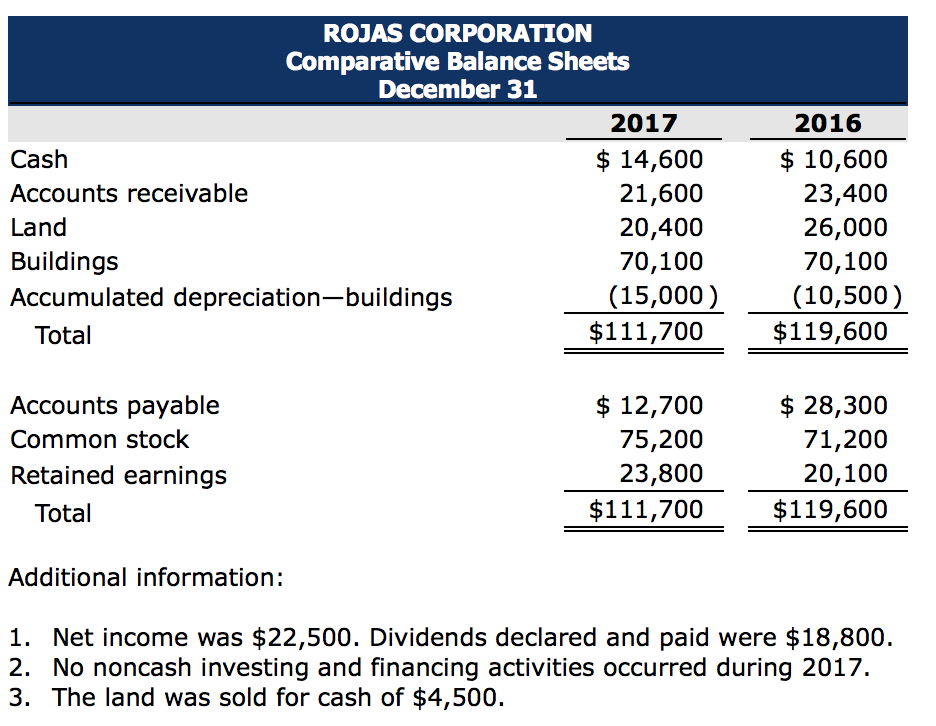

Cash Flow Statement Depreciation Expense AccountingCoach

Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. It's a credit balance deducted from the total cost of property, plant, and. Accumulated depreciation is under fixed assets on a balance sheet.

Balance Sheet Example With Depreciation

Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. It's a credit balance deducted from the total cost of property, plant, and. Accumulated depreciation is under fixed assets on a balance sheet.

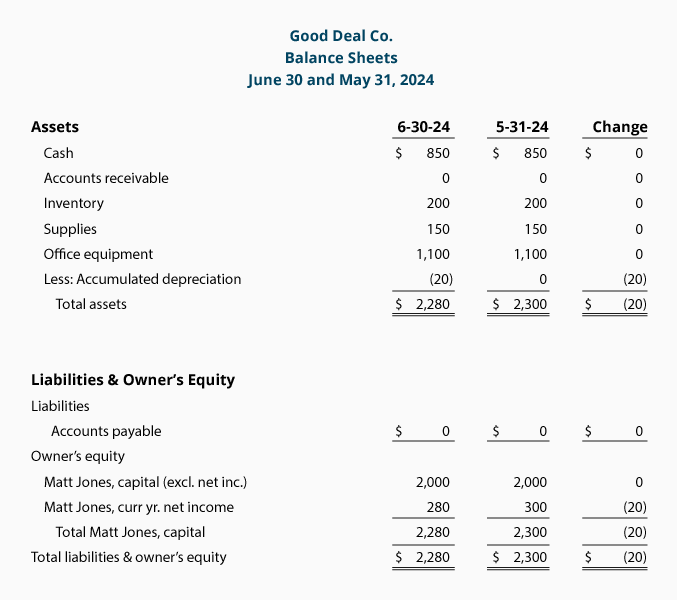

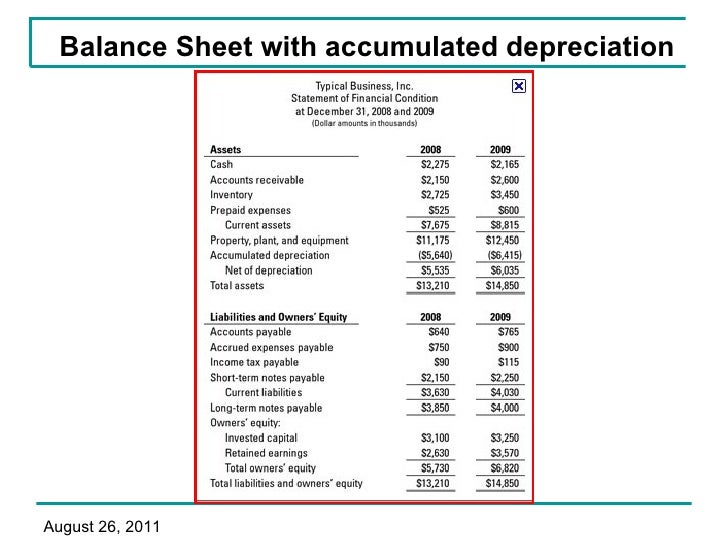

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

It's a credit balance deducted from the total cost of property, plant, and. Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. Accumulated depreciation is under fixed assets on a balance sheet. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account.

Balance Sheet Example With Depreciation

Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. Accumulated depreciation is under fixed assets on a balance sheet. It's a credit balance deducted from the total cost of property, plant, and. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account.

Balance Sheet Example With Depreciation

Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. It's a credit balance deducted from the total cost of property, plant, and. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Accumulated depreciation is under fixed assets on a balance sheet.

Depreciation

Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. It's a credit balance deducted from the total cost of property, plant, and. Accumulated depreciation is under fixed assets on a balance sheet. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account.

Accumulated Depreciation

Accumulated depreciation is under fixed assets on a balance sheet. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Depreciation expense is an accounting method that allocates the cost of an asset over its useful life. It's a credit balance deducted from the total cost of property, plant, and.

Accumulated Depreciation Overview, How it Works, Example

It's a credit balance deducted from the total cost of property, plant, and. Accumulated depreciation is under fixed assets on a balance sheet. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Depreciation expense is an accounting method that allocates the cost of an asset over its useful life.

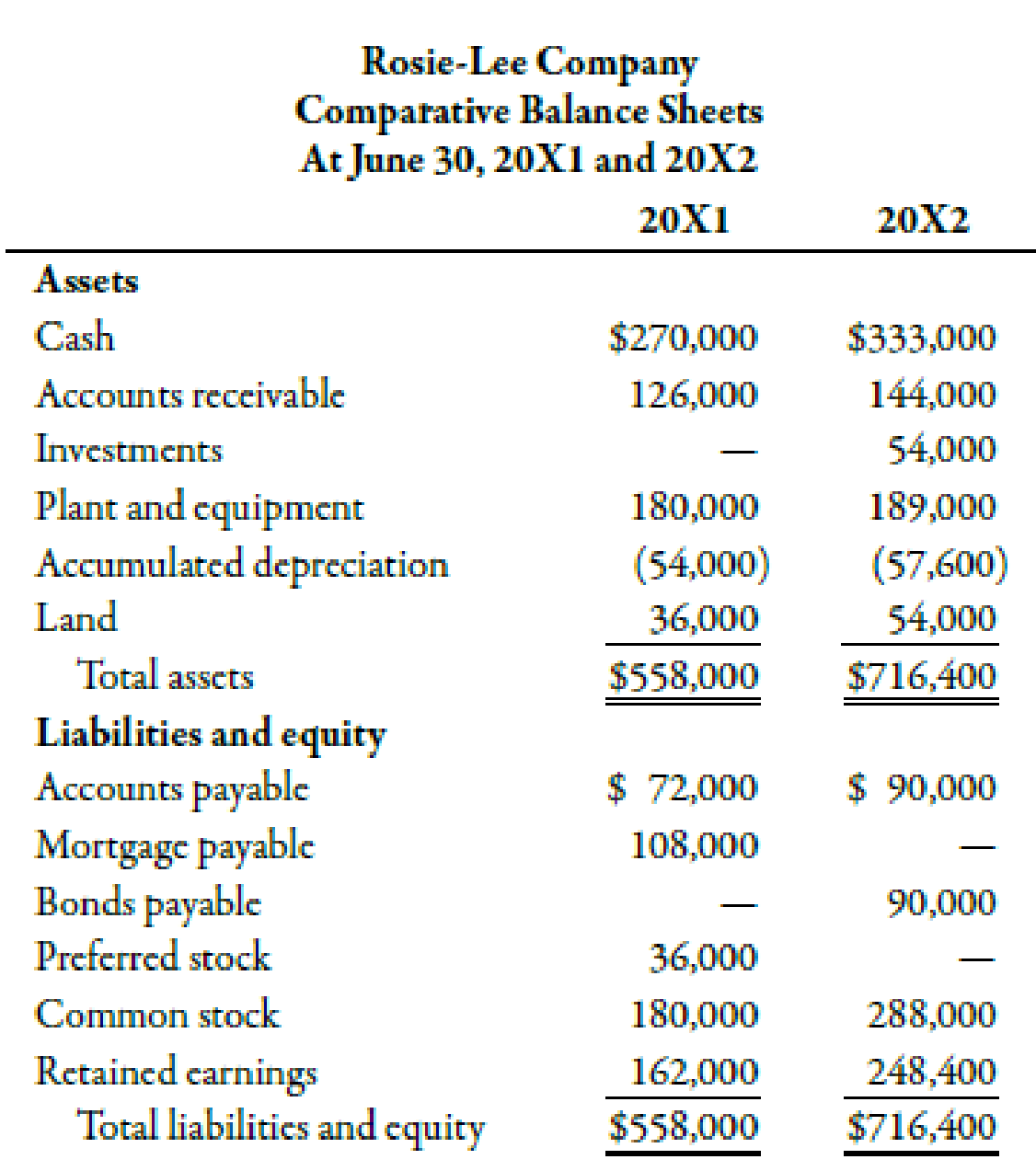

Depreciation Expense Is An Accounting Method That Allocates The Cost Of An Asset Over Its Useful Life.

It's a credit balance deducted from the total cost of property, plant, and. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Accumulated depreciation is under fixed assets on a balance sheet.