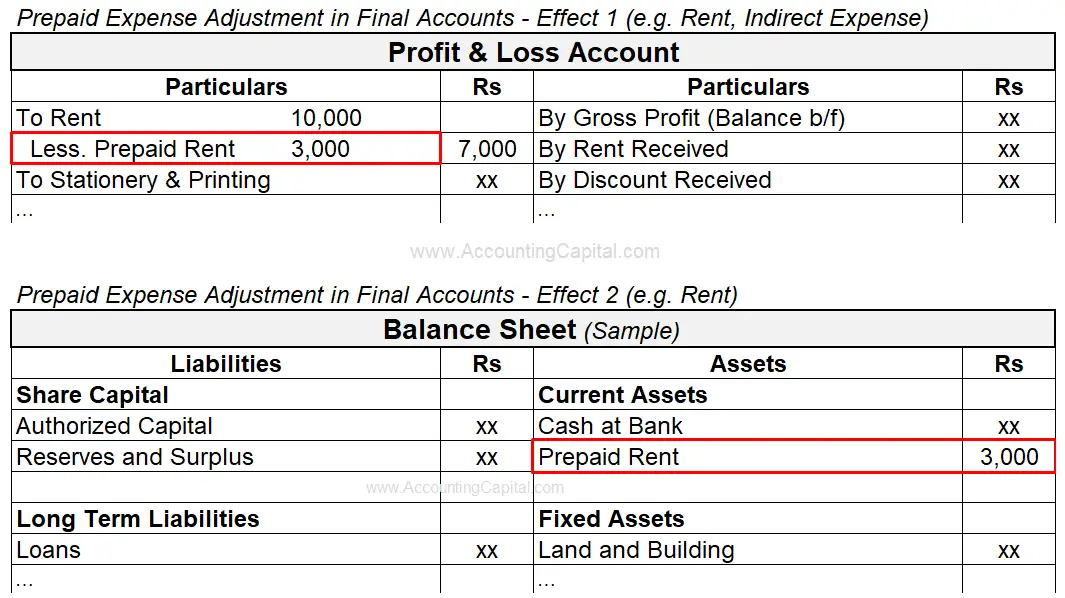

Prepaid Rent On Balance Sheet - In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. When a business pays rent in advance, it is essentially. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. The pre paid rent account is a balance. Prepaid rent typically represents multiple rent payments, while rent expense is a single. Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june.

Prepaid rent typically represents multiple rent payments, while rent expense is a single. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The pre paid rent account is a balance. The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. When a business pays rent in advance, it is essentially. Prepaid rent is a balance sheet account, and rent expense is an income statement account. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842.

Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid rent typically represents multiple rent payments, while rent expense is a single. When a business pays rent in advance, it is essentially. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. The pre paid rent account is a balance.

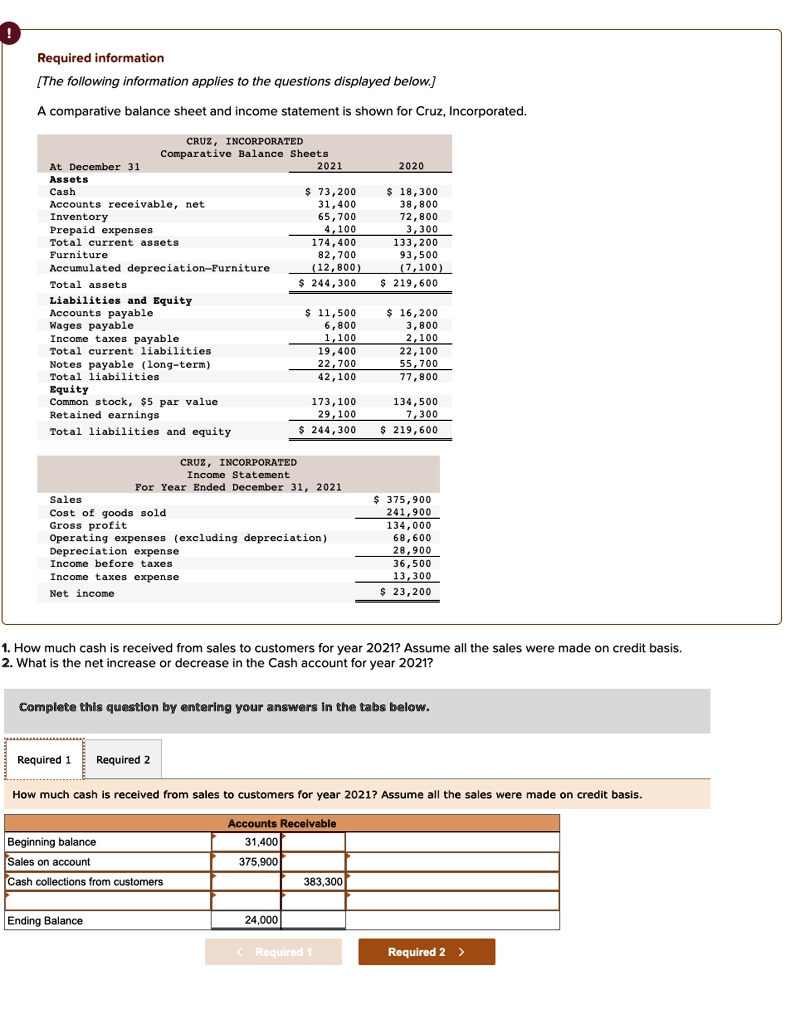

Prepaid Assets on Balance Sheet Quant RL

The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. Prepaid.

What Is The Basic Accounting Equation Explain With Suitable Example

Prepaid rent is a balance sheet account, and rent expense is an income statement account. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility.

Where Is Prepaid Rent On The Balance Sheet LiveWell

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Prepaid rent is a balance sheet account, and.

Free Prepaid Expense Schedule Excel Template Web Prepayments And

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid rent, often classified as a current asset on the balance sheet, represents.

The Adjusting Process And Related Entries laacib

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Prepaid rent is a balance sheet account, and.

What type of account is prepaid rent? Financial

The pre paid rent account is a balance. The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Prepaid rent is a balance.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

When a business pays rent in advance, it is essentially. The pre paid rent account is a balance. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The business has paid the rent in advance and has the right to use the premises for the following three month period.

Prepaid Expenses Meaning Example Entry Quiz & More..

In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. The pre paid rent account is a balance. When a business pays rent in advance, it is essentially. The business has paid the rent in advance and has the right to use the premises for the following three month period.

How Are Prepaid Expenses Recorded on the Statement?

The pre paid rent account is a balance. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Prepaid rent is a balance sheet account, and rent expense is an.

2011 Financial Discussion

The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. When a business pays rent in advance, it is essentially. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. Prepaid rent, often.

Prepaid Rent Is A Balance Sheet Account, And Rent Expense Is An Income Statement Account.

In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. The pre paid rent account is a balance. When a business pays rent in advance, it is essentially. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then.

Prepaid Rent Typically Represents Multiple Rent Payments, While Rent Expense Is A Single.

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-04-59546336082445fa8db2dd9bbfcf58cb.jpg)