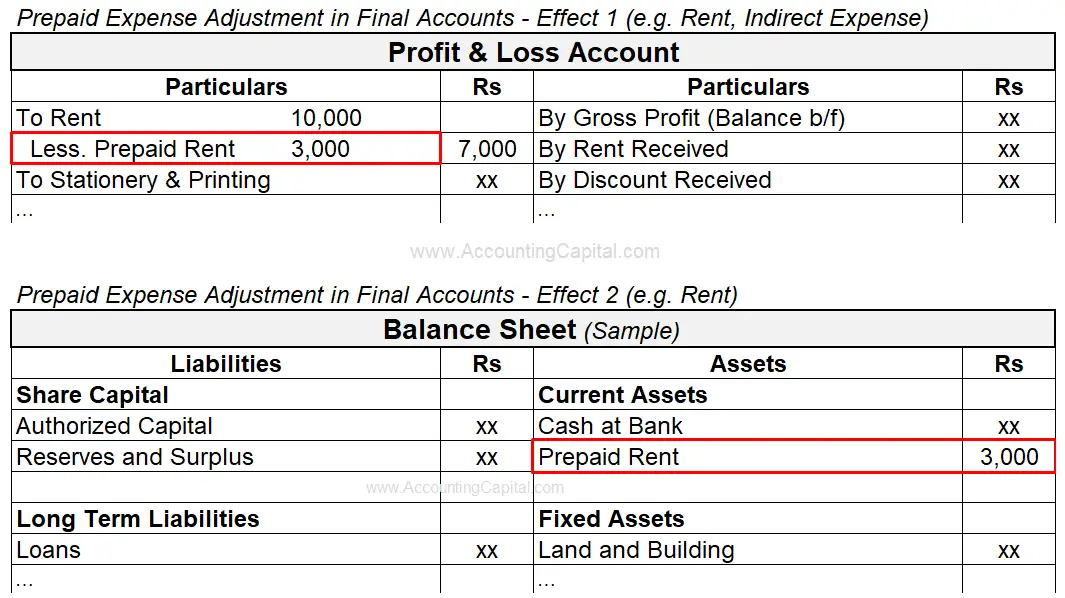

Prepaid Rent Balance Sheet - What it does simply trades one asset. The proper way to account for prepaid rent is to record the initial payment in the. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Example of prepaid rent accounting.

The proper way to account for prepaid rent is to record the initial payment in the. Example of prepaid rent accounting. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. What it does simply trades one asset.

Example of prepaid rent accounting. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. The proper way to account for prepaid rent is to record the initial payment in the. What it does simply trades one asset. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company.

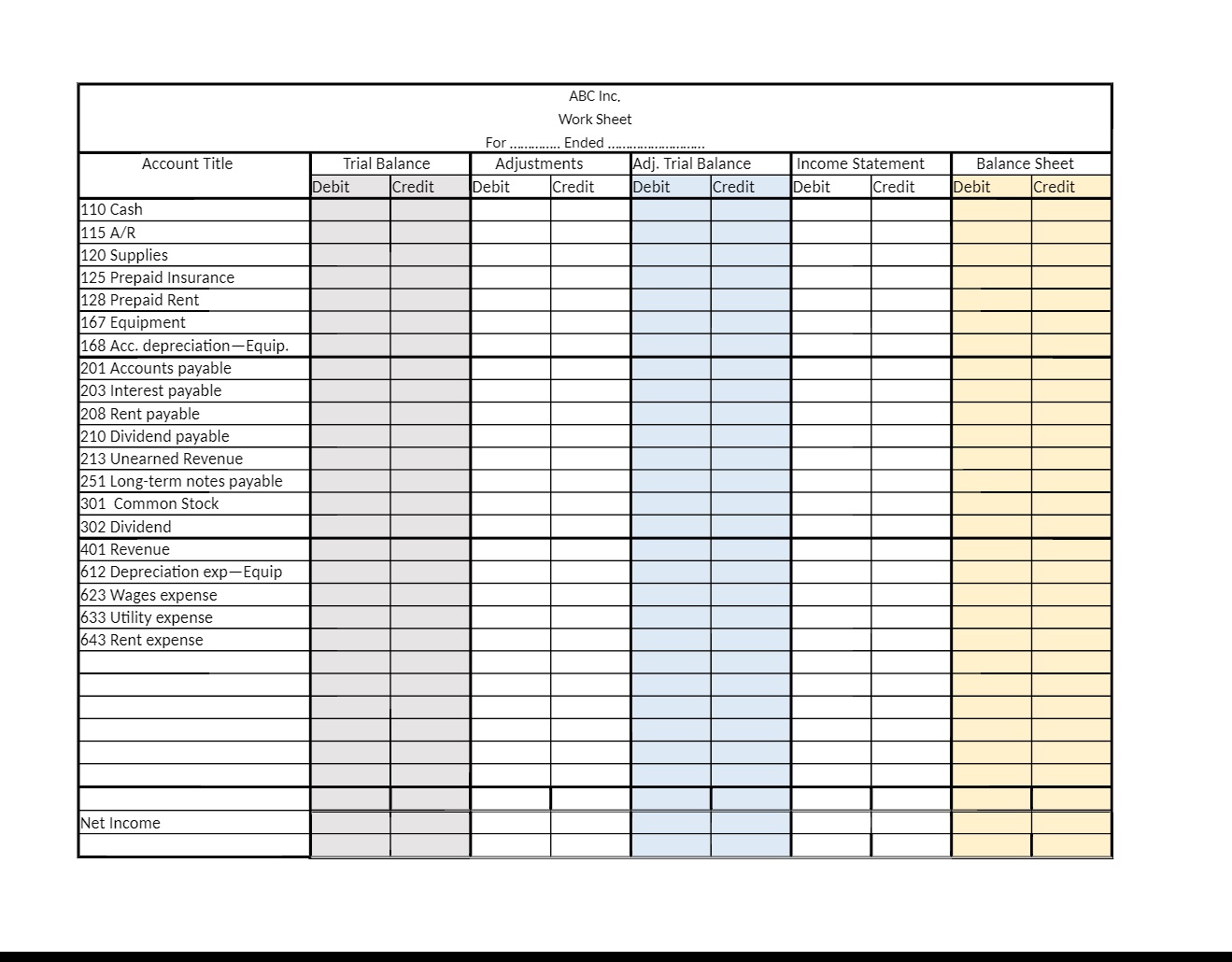

Free Prepaid Expense Schedule Excel Template Web Prepayments And

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Example of prepaid rent accounting. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. What it does simply trades one asset. The proper way to account for prepaid rent is to record the.

Prepaid Assets on Balance Sheet Quant RL

The proper way to account for prepaid rent is to record the initial payment in the. What it does simply trades one asset. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Example.

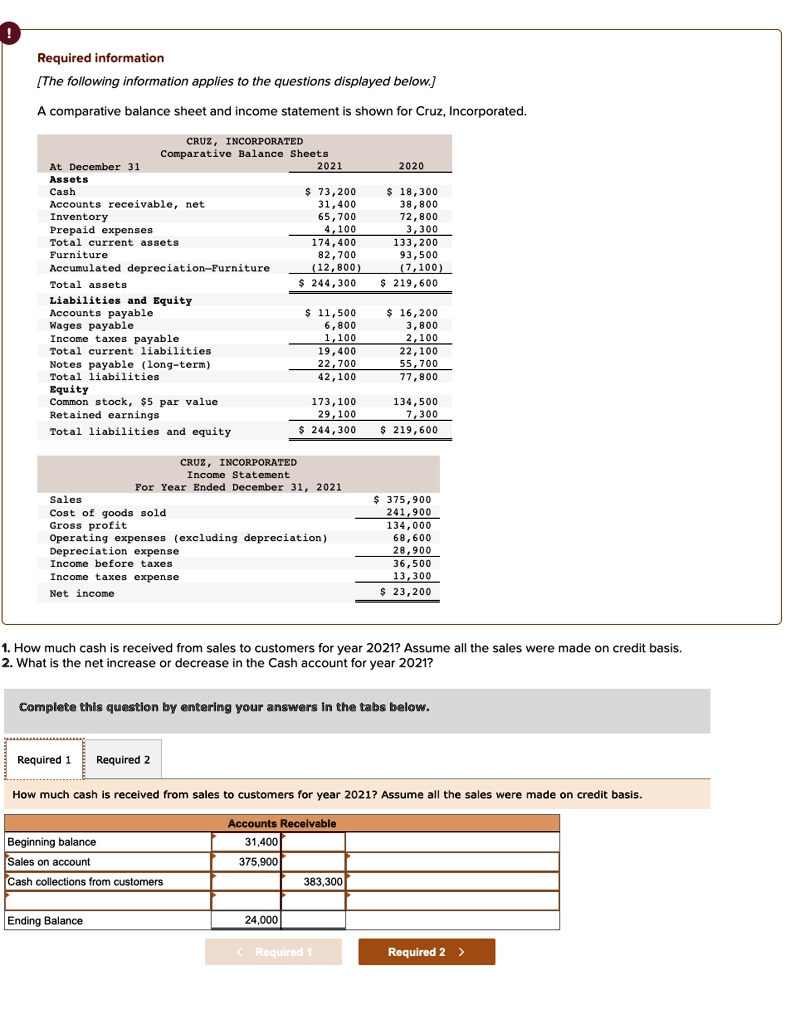

2011 Financial Discussion

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. The proper way to account for prepaid rent is to record the initial payment in the. What it does simply trades one asset. Example.

Where Is Prepaid Rent On The Balance Sheet LiveWell

The proper way to account for prepaid rent is to record the initial payment in the. What it does simply trades one asset. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Example.

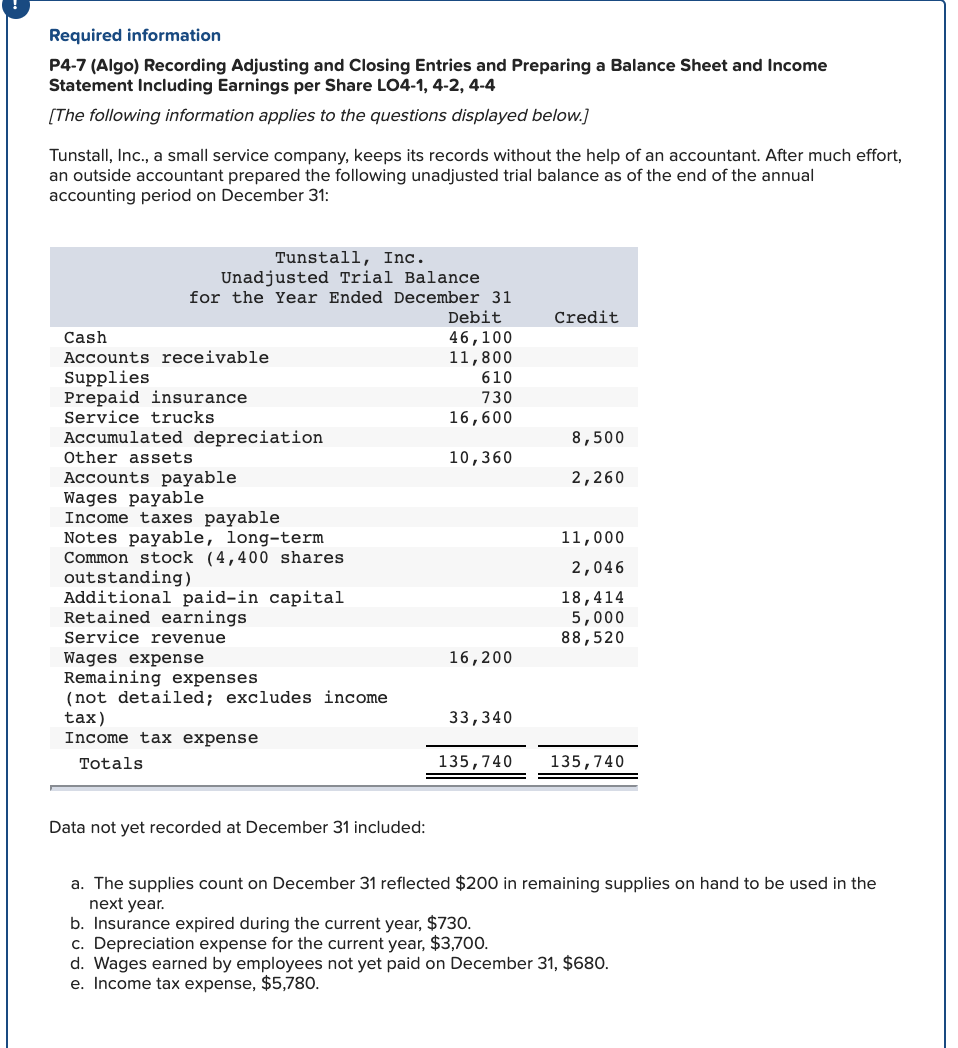

Solved Please help complete balance sheet. Prepaid insurance

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Example of prepaid rent accounting. The proper way to account for prepaid rent is to record the initial payment in the. What it does simply trades one asset. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets.

What Is The Basic Accounting Equation Explain With Suitable Example

The proper way to account for prepaid rent is to record the initial payment in the. What it does simply trades one asset. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Example of prepaid rent accounting. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

The proper way to account for prepaid rent is to record the initial payment in the. Example of prepaid rent accounting. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. What it does simply trades one asset. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic.

Prepaid Expenses Meaning Example Entry Quiz & More..

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The proper way to account for prepaid rent is to record the initial payment in the. What it does simply trades one asset. Example of prepaid rent accounting. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets.

How Are Prepaid Expenses Recorded on the Statement?

Example of prepaid rent accounting. The proper way to account for prepaid rent is to record the initial payment in the. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. What it does.

What type of account is prepaid rent? Financial

What it does simply trades one asset. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Example of prepaid rent accounting. The proper way to account for prepaid rent is to record the initial payment in the. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic.

What It Does Simply Trades One Asset.

Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The proper way to account for prepaid rent is to record the initial payment in the. Example of prepaid rent accounting.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-04-59546336082445fa8db2dd9bbfcf58cb.jpg)