Interest Payable On Balance Sheet - Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. Interest payable = principal amount × interest rate × time. The amount of interest payable on a balance sheet may be much critical from financial statement analysis perspective. At the end of the period, the company will have to recognize interest payable in the balance sheet and interest expenses in the. The basic formula for calculating interest payable is:

The basic formula for calculating interest payable is: Interest payable = principal amount × interest rate × time. Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. The amount of interest payable on a balance sheet may be much critical from financial statement analysis perspective. At the end of the period, the company will have to recognize interest payable in the balance sheet and interest expenses in the.

Interest payable = principal amount × interest rate × time. The basic formula for calculating interest payable is: Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. At the end of the period, the company will have to recognize interest payable in the balance sheet and interest expenses in the. The amount of interest payable on a balance sheet may be much critical from financial statement analysis perspective.

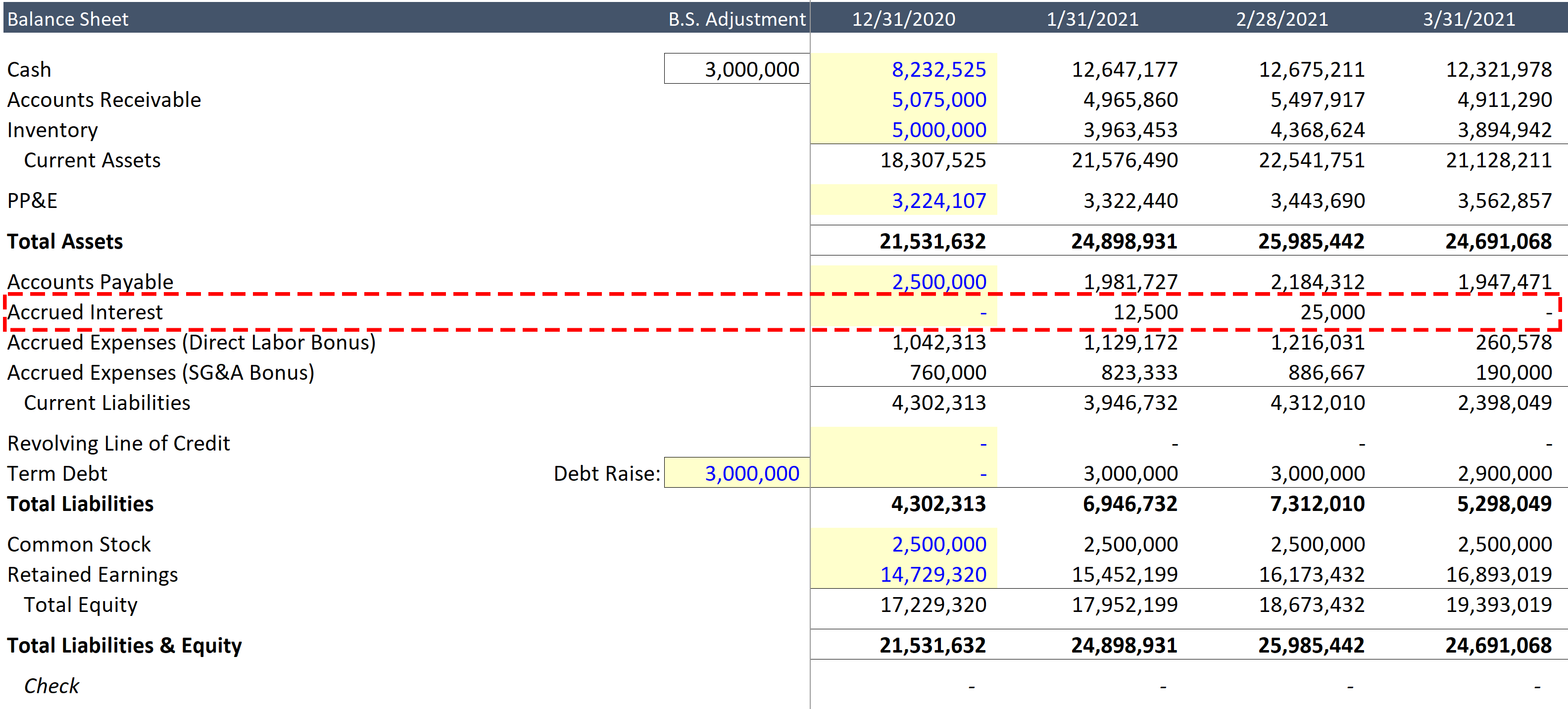

Interest Expense in a Monthly Financial Model (Cash Interest vs

Interest payable = principal amount × interest rate × time. The basic formula for calculating interest payable is: Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. At the end of the period, the company will have to recognize interest payable in the balance sheet and interest.

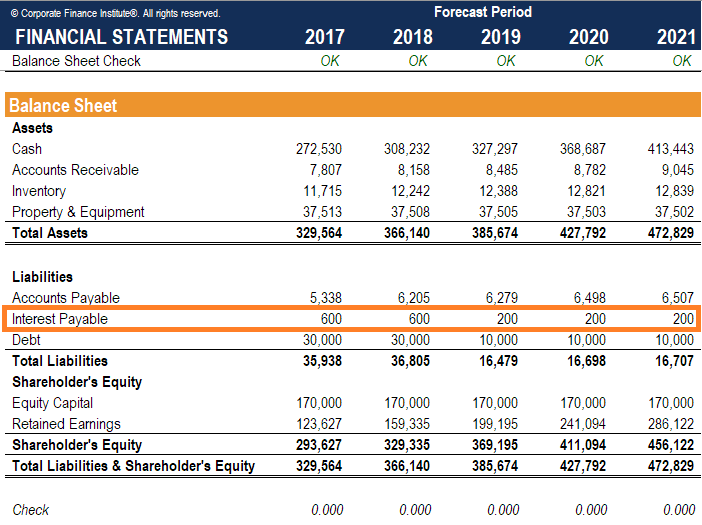

Bond Related Accounts on the Balance Sheet Wize University

Interest payable = principal amount × interest rate × time. The basic formula for calculating interest payable is: At the end of the period, the company will have to recognize interest payable in the balance sheet and interest expenses in the. Interest payable is the amount of interest on its debt and capital leases that a company owes to its.

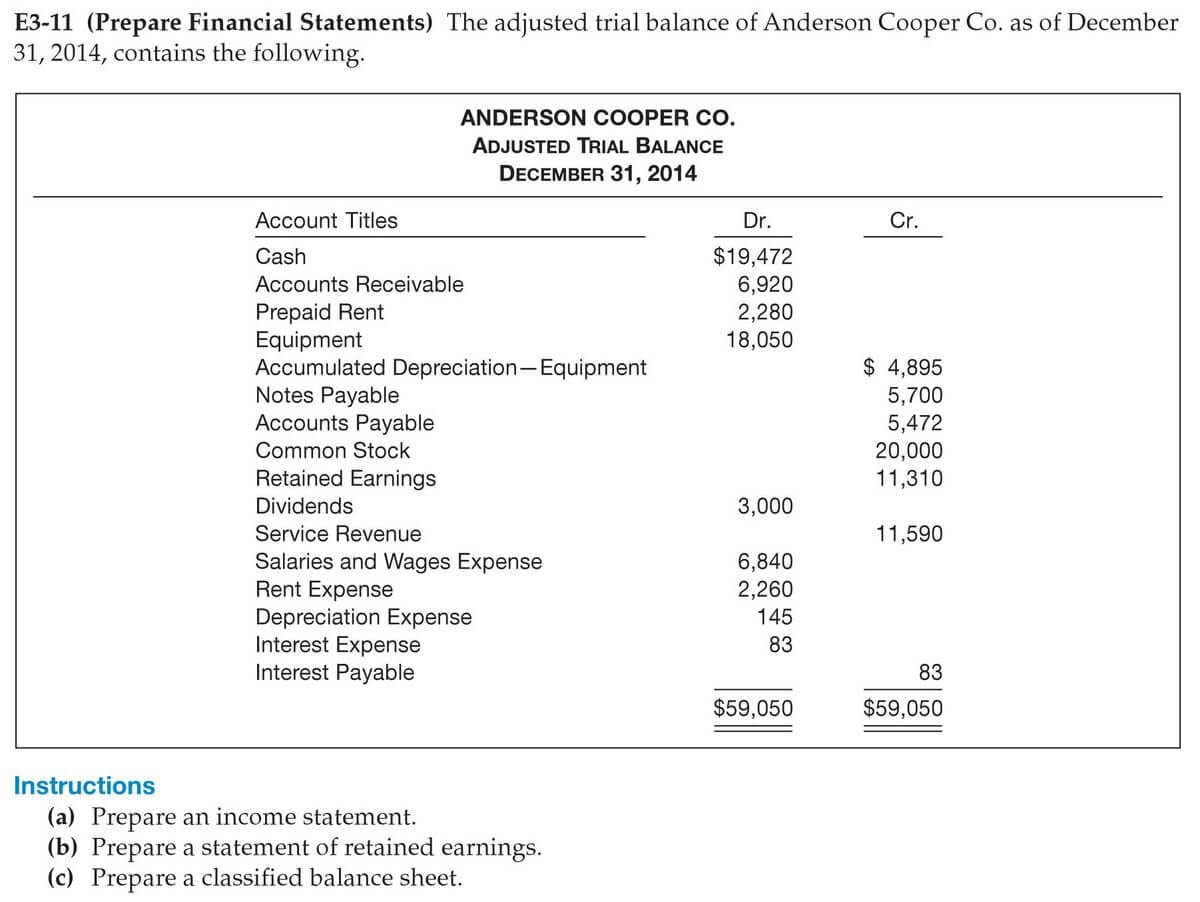

Interest Payable

The basic formula for calculating interest payable is: At the end of the period, the company will have to recognize interest payable in the balance sheet and interest expenses in the. Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. The amount of interest payable on a.

Favorite Interest Receivable On Balance Sheet 26as Statement Means

Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. Interest payable = principal amount × interest rate × time. The amount of interest payable on a balance sheet may be much critical from financial statement analysis perspective. At the end of the period, the company will have.

Exemplary Tips About Interest Balance Sheet Corelee

The basic formula for calculating interest payable is: The amount of interest payable on a balance sheet may be much critical from financial statement analysis perspective. Interest payable = principal amount × interest rate × time. Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. At the.

Beautiful Work Info About Interest Payable On Balance Sheet Typea

At the end of the period, the company will have to recognize interest payable in the balance sheet and interest expenses in the. The basic formula for calculating interest payable is: Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. Interest payable = principal amount × interest.

Notes Payable Accounting Double Entry Bookkeeping

The basic formula for calculating interest payable is: Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. At the end of the period, the company will have to recognize interest payable in the balance sheet and interest expenses in the. Interest payable = principal amount × interest.

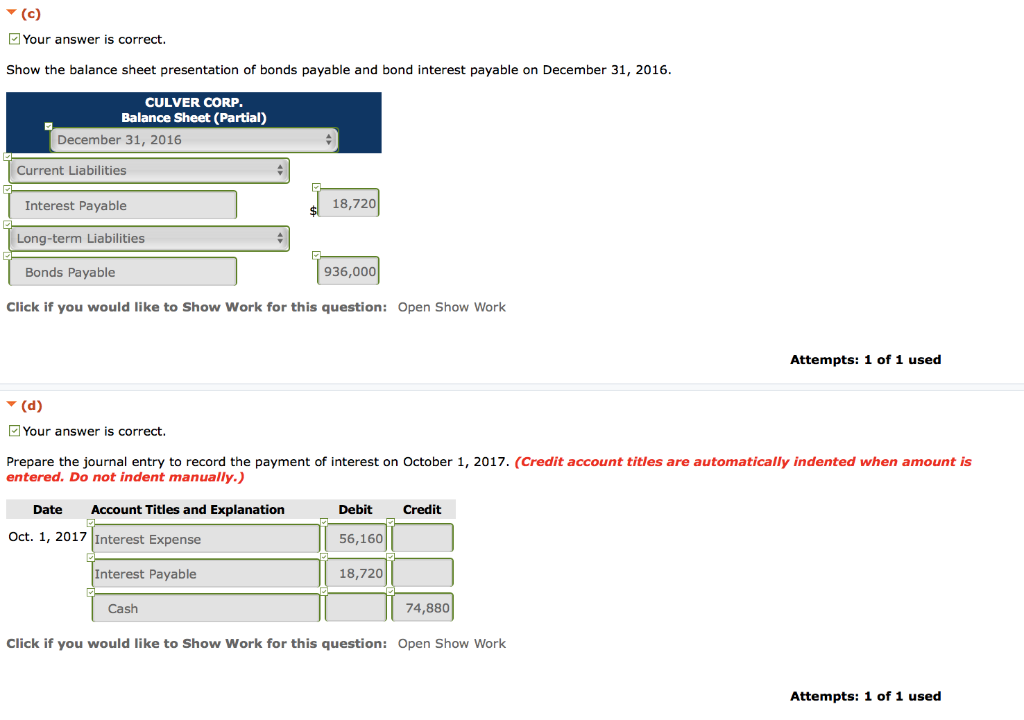

Solved (c) Your answer is correct. Show the balance sheet

At the end of the period, the company will have to recognize interest payable in the balance sheet and interest expenses in the. Interest payable = principal amount × interest rate × time. Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. The basic formula for calculating.

Business Interests Understanding Receivables and Inventory

Interest payable = principal amount × interest rate × time. Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. The basic formula for calculating interest payable is: The amount of interest payable on a balance sheet may be much critical from financial statement analysis perspective. At the.

Beautiful Work Info About Interest Payable On Balance Sheet Typea

Interest payable = principal amount × interest rate × time. Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. At the end of the period, the company will have to recognize interest payable in the balance sheet and interest expenses in the. The amount of interest payable.

The Amount Of Interest Payable On A Balance Sheet May Be Much Critical From Financial Statement Analysis Perspective.

Interest payable is the amount of interest on its debt and capital leases that a company owes to its lenders and lease. Interest payable = principal amount × interest rate × time. The basic formula for calculating interest payable is: At the end of the period, the company will have to recognize interest payable in the balance sheet and interest expenses in the.