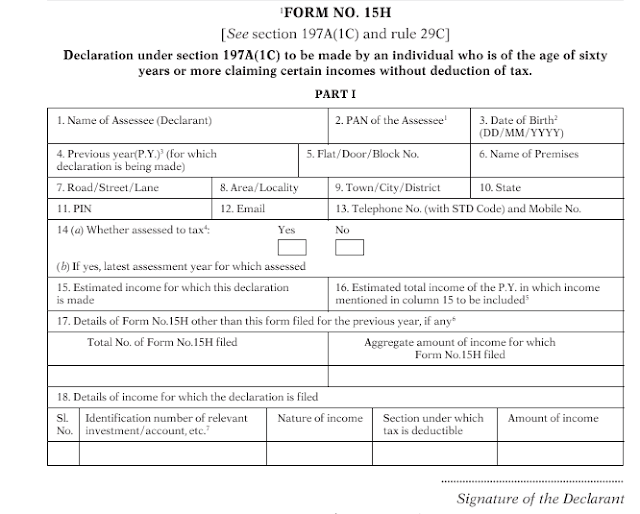

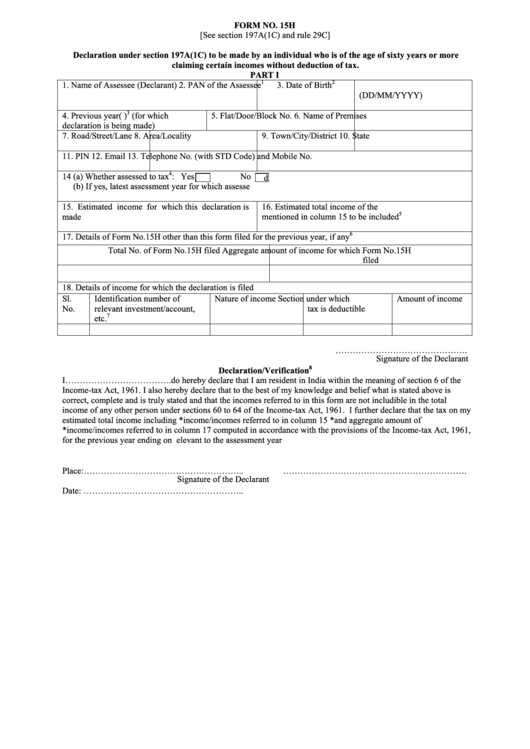

Income Tax Form 15H - Declaration under section 197a(1c) to be made by an individual who is of. Income section under which tax is deductible amount of income sl. Before signing the verification, the declarant should satisfy himself that the information.

Before signing the verification, the declarant should satisfy himself that the information. Income section under which tax is deductible amount of income sl. Declaration under section 197a(1c) to be made by an individual who is of.

Declaration under section 197a(1c) to be made by an individual who is of. Income section under which tax is deductible amount of income sl. Before signing the verification, the declarant should satisfy himself that the information.

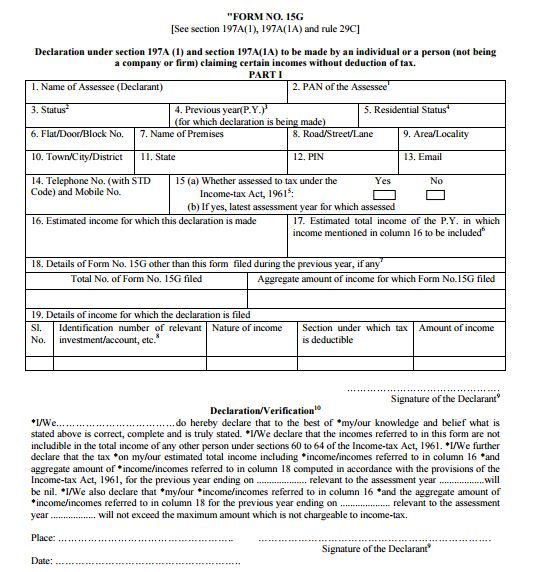

Form 15H Format 1 PDF Tax Taxes

Before signing the verification, the declarant should satisfy himself that the information. Declaration under section 197a(1c) to be made by an individual who is of. Income section under which tax is deductible amount of income sl.

Form 15G and Form 15H Save TDS on Interest

Declaration under section 197a(1c) to be made by an individual who is of. Income section under which tax is deductible amount of income sl. Before signing the verification, the declarant should satisfy himself that the information.

Form 15G Form 15H TDS on interest Tax Deduction

Income section under which tax is deductible amount of income sl. Declaration under section 197a(1c) to be made by an individual who is of. Before signing the verification, the declarant should satisfy himself that the information.

Form 15G and Form 15H in Tax

Income section under which tax is deductible amount of income sl. Declaration under section 197a(1c) to be made by an individual who is of. Before signing the verification, the declarant should satisfy himself that the information.

Form 15G and Form 15H in Tax

Income section under which tax is deductible amount of income sl. Before signing the verification, the declarant should satisfy himself that the information. Declaration under section 197a(1c) to be made by an individual who is of.

Tax Form 15H and Form 15G

Income section under which tax is deductible amount of income sl. Declaration under section 197a(1c) to be made by an individual who is of. Before signing the verification, the declarant should satisfy himself that the information.

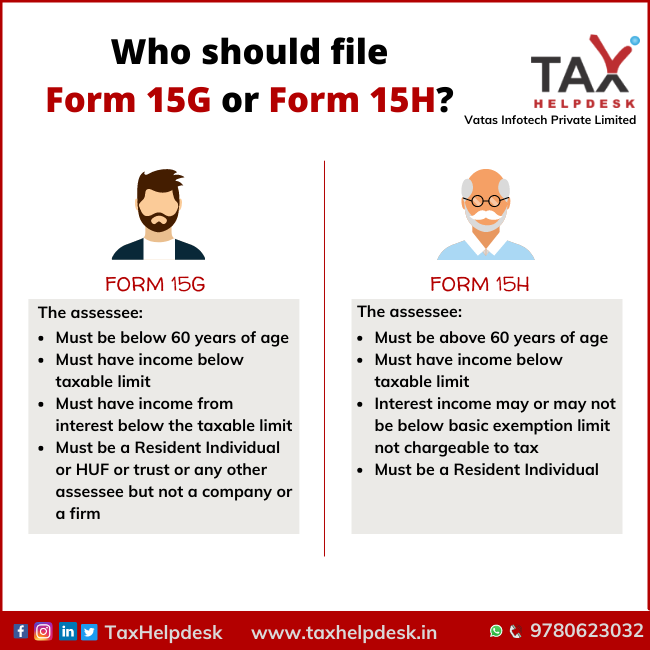

Know Who should file Form 15G and Form 15H? TaxHelpdesk

Declaration under section 197a(1c) to be made by an individual who is of. Before signing the verification, the declarant should satisfy himself that the information. Income section under which tax is deductible amount of income sl.

Fillable Online Form 15h tax pdf. Form 15h tax pdf

Before signing the verification, the declarant should satisfy himself that the information. Declaration under section 197a(1c) to be made by an individual who is of. Income section under which tax is deductible amount of income sl.

Form 15G and Form 15H in Tax

Income section under which tax is deductible amount of income sl. Before signing the verification, the declarant should satisfy himself that the information. Declaration under section 197a(1c) to be made by an individual who is of.

Income Section Under Which Tax Is Deductible Amount Of Income Sl.

Declaration under section 197a(1c) to be made by an individual who is of. Before signing the verification, the declarant should satisfy himself that the information.