How Are Drip Programs Recorded On The Balance Sheet - Drips give stock market investors who own shares in a particular company the opportunity to receive dividend payments either in the form of. A dividend reinvestment plan (drip) is an investment strategy in which investors reinvest their cash dividends in the company. Drips help shareholders reinvest their. Investors also need to be aware that the. Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock. Drips, which are also known as dividend reinvestment programs, give shareholders the option of reinvesting the. Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. Drips are a way to build up additional shares over time for a potential payoff in higher capital gains.

A dividend reinvestment plan (drip) is an investment strategy in which investors reinvest their cash dividends in the company. Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock. Drips give stock market investors who own shares in a particular company the opportunity to receive dividend payments either in the form of. Drips help shareholders reinvest their. Drips are a way to build up additional shares over time for a potential payoff in higher capital gains. Investors also need to be aware that the. Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. Drips, which are also known as dividend reinvestment programs, give shareholders the option of reinvesting the.

Drips are a way to build up additional shares over time for a potential payoff in higher capital gains. Drips, which are also known as dividend reinvestment programs, give shareholders the option of reinvesting the. Investors also need to be aware that the. Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. Drips help shareholders reinvest their. Drips give stock market investors who own shares in a particular company the opportunity to receive dividend payments either in the form of. A dividend reinvestment plan (drip) is an investment strategy in which investors reinvest their cash dividends in the company. Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock.

Drip Programs Ppt Powerpoint Presentation Icon Graphic Images Cpb

Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock. Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. Drips, which are also known as dividend reinvestment programs, give shareholders the option of reinvesting the. Drips give stock market investors who own shares in a particular company the opportunity to receive dividend payments.

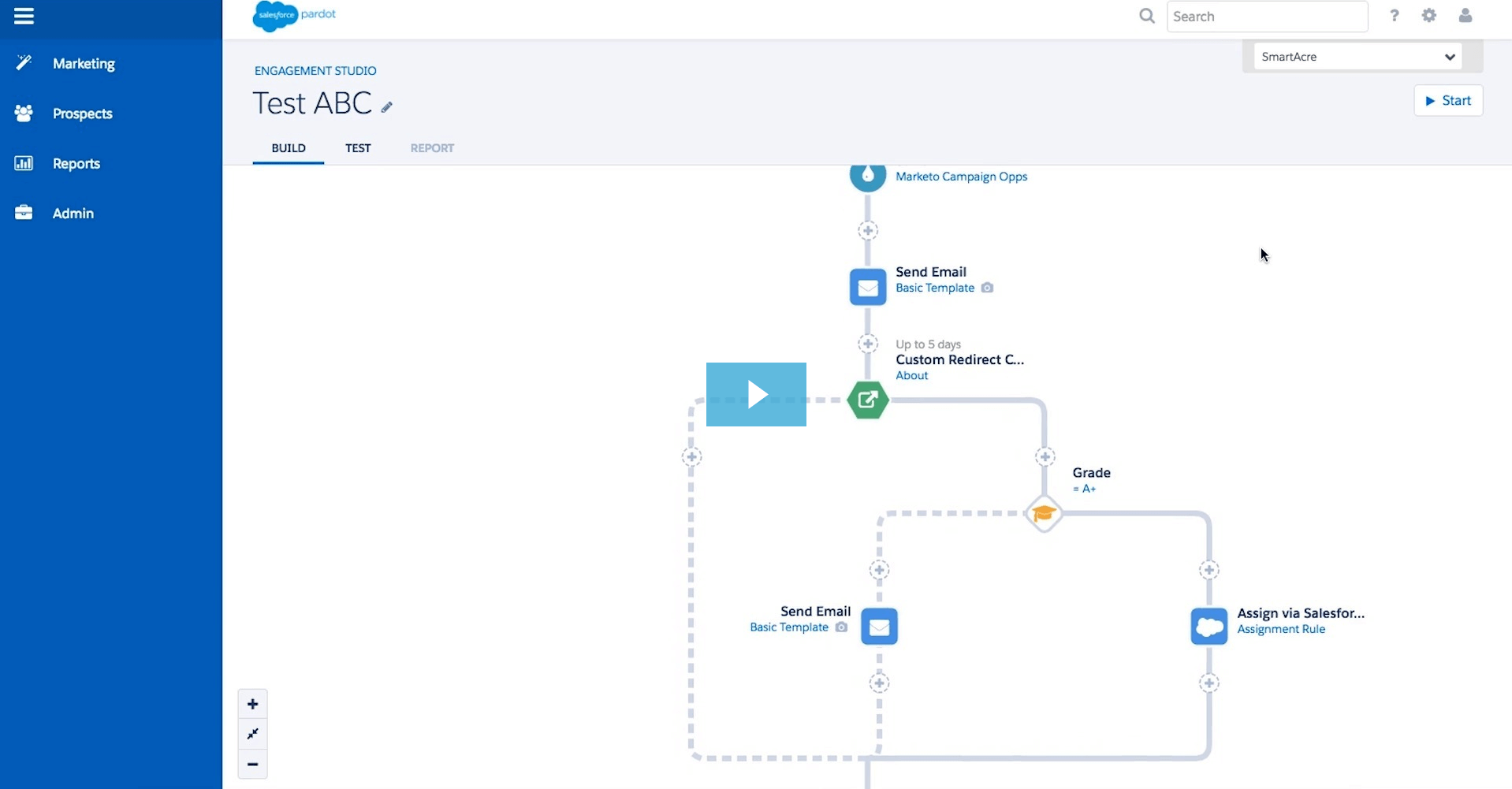

Setting up Pardot engagement studio drip programs YouTube

Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock. Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. Drips, which are also known as dividend reinvestment programs, give shareholders the option of reinvesting the. A dividend reinvestment plan (drip) is an investment strategy in which investors reinvest their cash dividends in the.

The Best DRIP Stocks Now 15 NoFee Dividend Aristocrats The Kenyan

A dividend reinvestment plan (drip) is an investment strategy in which investors reinvest their cash dividends in the company. Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock. Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. Drips, which are also known as dividend reinvestment programs, give shareholders the option of reinvesting.

👊💵🔥In my opinion, DRIPS are worth looking into if you are a long term

Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock. Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. Drips give stock market investors who own shares in a particular company the opportunity to receive dividend payments either in the form of. Drips are a way to build up additional shares over time.

DRIP Programs Invest CommissionFree in the Best Stocks YouTube

Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock. Drips are a way to build up additional shares over time for a potential payoff in higher capital gains. Drips give stock market investors who own shares in a particular company the opportunity to.

Conservation Programs Current and Proposed ppt download

Investors also need to be aware that the. Drips are a way to build up additional shares over time for a potential payoff in higher capital gains. Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock. Drips, which are also known as dividend reinvestment programs, give shareholders the option of reinvesting the. A dividend reinvestment plan (drip) is.

[Sponsored] Introduction Dividend Reinvestment Plan (DRP/DRIP

Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. A dividend reinvestment plan (drip) is an investment strategy in which investors reinvest their cash dividends in the company. Drips are a way to build up additional shares over time for a potential payoff in higher capital gains. Dividend reinvestment plans (drips) automatically reinvest cash.

DRIP Balance Integrating with Your Other Investment Plans!

Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. Drips, which are also known as dividend reinvestment programs, give shareholders the option of reinvesting the. Drips are a way to build up additional shares over time for a potential payoff in higher capital gains. Dividend reinvestment plans (drips) automatically reinvest cash dividends in the.

Drip Campaigns Introduction to Drip Marketing with Pardot Engagement

Drips, which are also known as dividend reinvestment programs, give shareholders the option of reinvesting the. Drips help shareholders reinvest their. Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock. Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. Drips give stock market investors who own shares in a particular company the.

SmartPRP RechargeRx Drip Program Supakunn Clinic

Investors also need to be aware that the. Drips give stock market investors who own shares in a particular company the opportunity to receive dividend payments either in the form of. Drips, which are also known as dividend reinvestment programs, give shareholders the option of reinvesting the. Drips help shareholders reinvest their. Dividend reinvestment plans (drips) automatically reinvest cash dividends.

Drips, Which Are Also Known As Dividend Reinvestment Programs, Give Shareholders The Option Of Reinvesting The.

Dividend reinvestment plans (drips) dividend reinvestment plans, or drips, allow shareholders to reinvest dividends into. A dividend reinvestment plan (drip) is an investment strategy in which investors reinvest their cash dividends in the company. Investors also need to be aware that the. Dividend reinvestment plans (drips) automatically reinvest cash dividends in the stock.

Drips Give Stock Market Investors Who Own Shares In A Particular Company The Opportunity To Receive Dividend Payments Either In The Form Of.

Drips help shareholders reinvest their. Drips are a way to build up additional shares over time for a potential payoff in higher capital gains.

![[Sponsored] Introduction Dividend Reinvestment Plan (DRP/DRIP](https://nomoneylah.com/wp-content/uploads/2022/08/DRIP-INFOGRAPHIC-PG2.jpg)