Does Rent Expense Go On The Balance Sheet - In short, organizations will now have to record both an asset and a liability for their operating leases. It is useful to always read both. Rent expense is not reported on the balance sheet. In short, expenses appear directly in the income statement and indirectly in the balance sheet. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Under standards like ifrs 16 and asc 842, companies. Rent expense on the balance sheet. It is still only reported on the income statement. Rent also impacts the balance sheet in the context of lease accounting.

Under standards like ifrs 16 and asc 842, companies. In short, organizations will now have to record both an asset and a liability for their operating leases. Rent also impacts the balance sheet in the context of lease accounting. It is useful to always read both. Rent expense is not reported on the balance sheet. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent expense on the balance sheet. In short, expenses appear directly in the income statement and indirectly in the balance sheet. It is still only reported on the income statement.

Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Under standards like ifrs 16 and asc 842, companies. Rent also impacts the balance sheet in the context of lease accounting. In short, organizations will now have to record both an asset and a liability for their operating leases. Rent expense is not reported on the balance sheet. It is useful to always read both. It is still only reported on the income statement. In short, expenses appear directly in the income statement and indirectly in the balance sheet. Rent expense on the balance sheet.

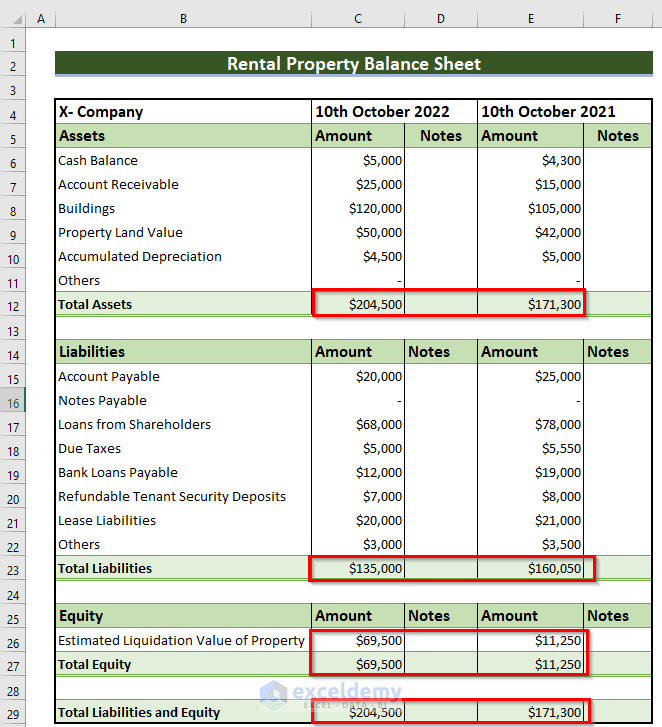

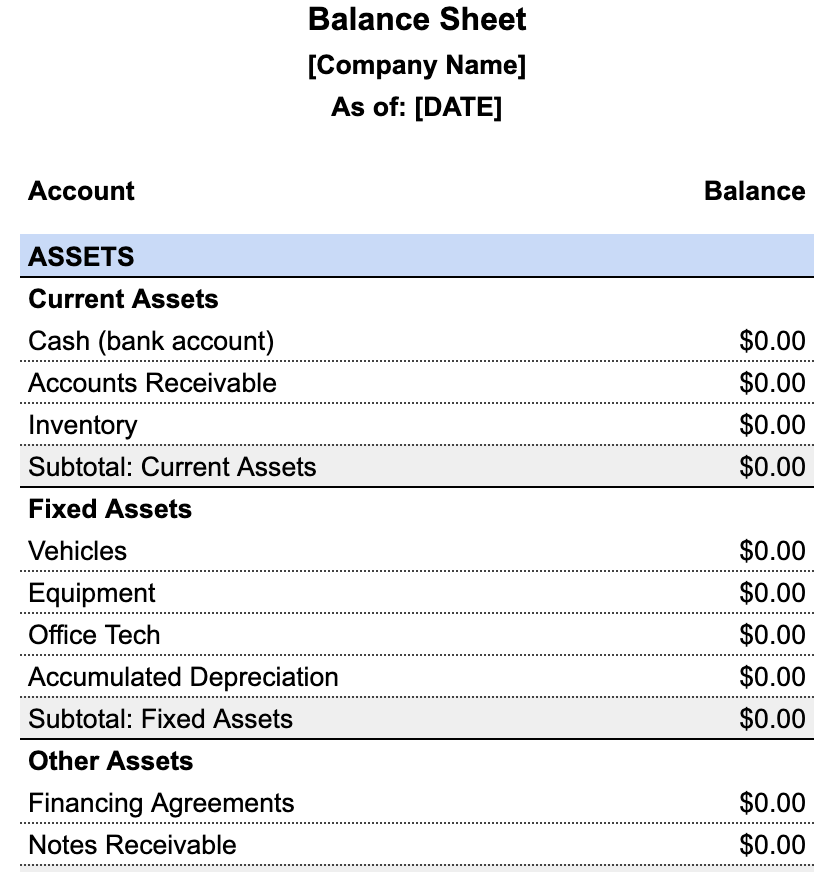

Rental Property Balance Sheet in Excel 2 Methods (Free Template)

It is still only reported on the income statement. Under standards like ifrs 16 and asc 842, companies. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent also impacts the balance sheet in the context of lease accounting. Rent expense is not reported on the balance sheet.

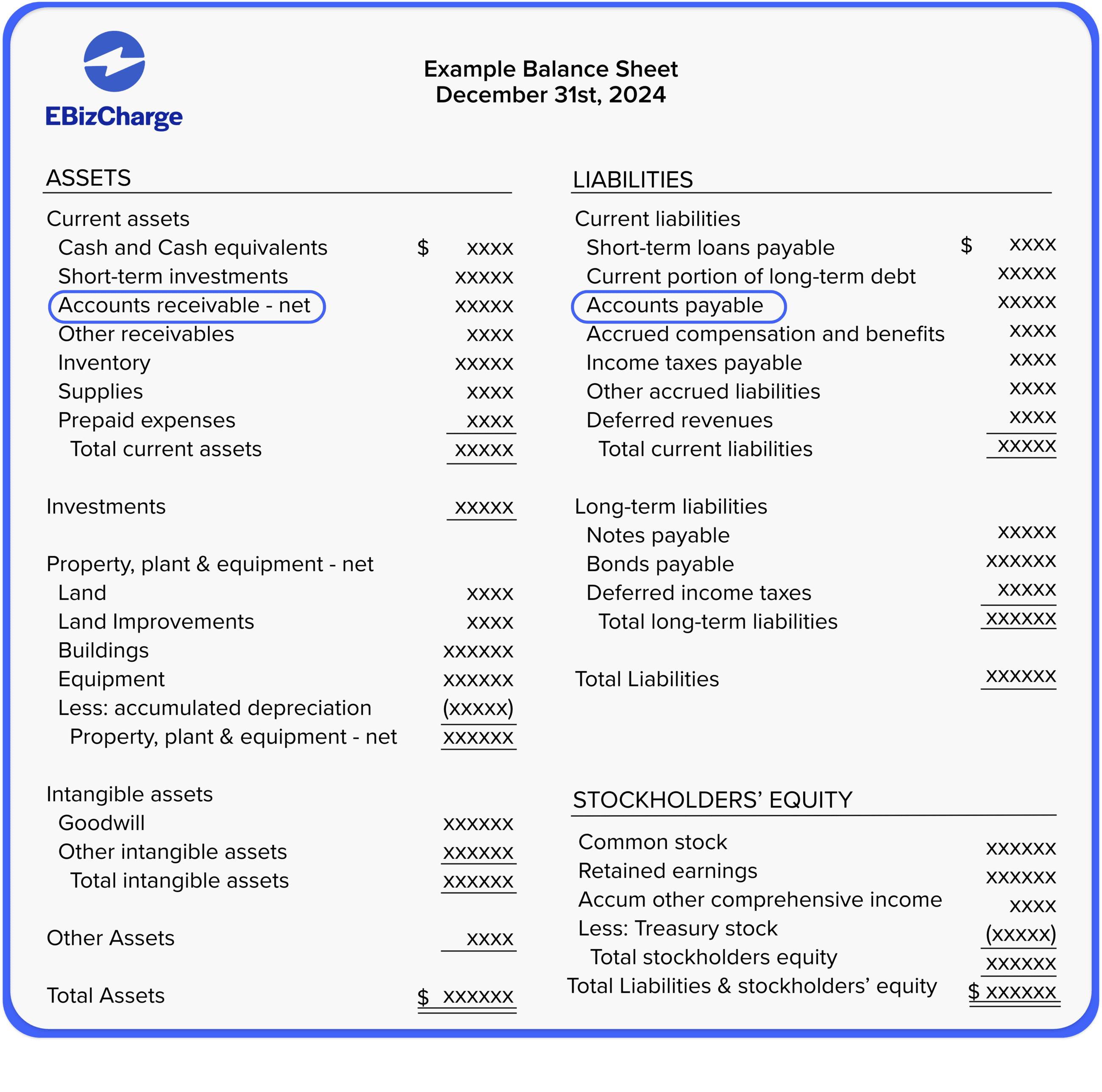

What are Accounts Receivable and Accounts Payable?

Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. It is still only reported on the income statement. Rent expense is not reported on the balance sheet. It is useful to always read both. In short, expenses appear directly in the income statement and indirectly in the balance sheet.

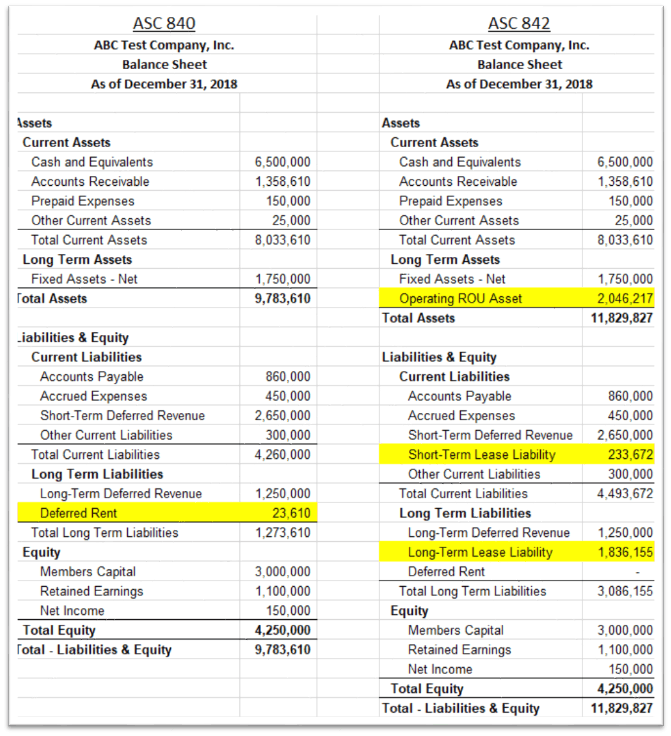

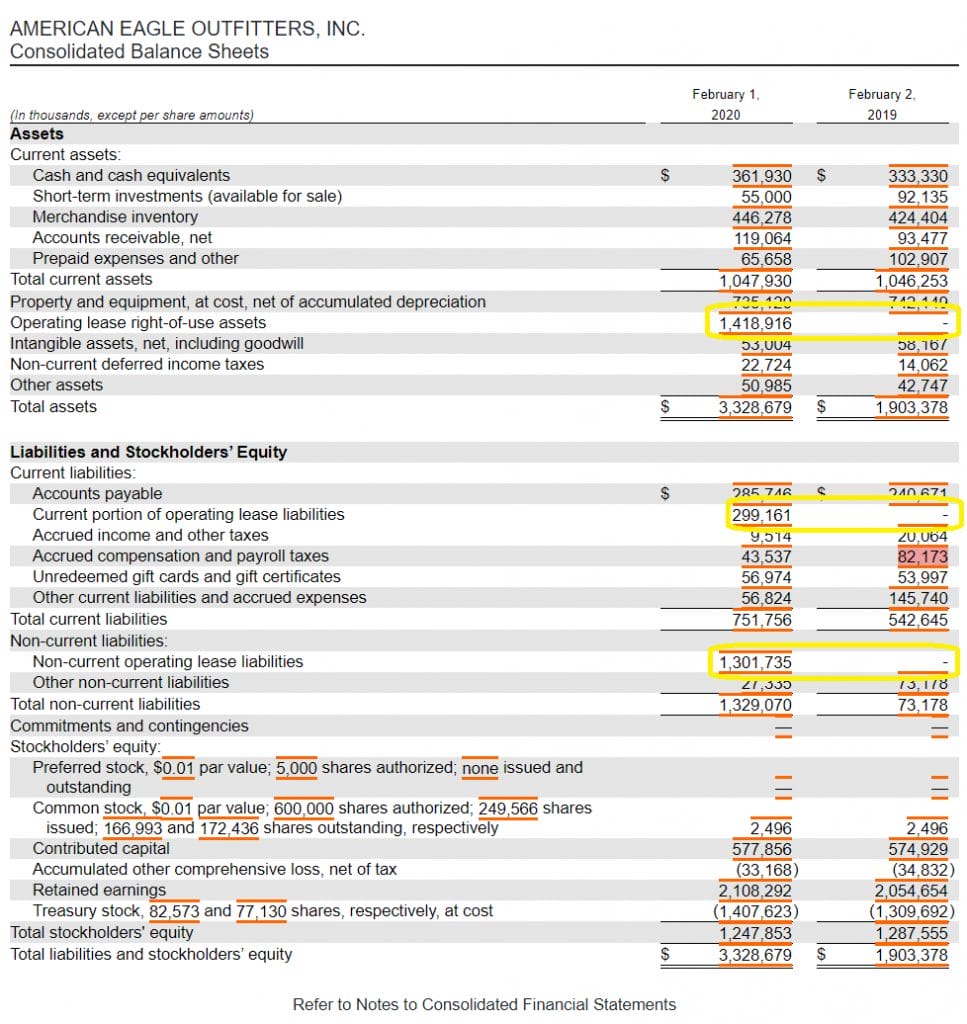

Accounting for Operating Leases in the Balance Sheet Simply Explained

Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. In short, organizations will now have to record both an asset and a liability for their operating leases. In short, expenses appear directly in the income statement and indirectly in the balance sheet. It is still only reported on the.

Beginner's Guide To Understanding Your Balance Sheet (1) Elements Of

In short, organizations will now have to record both an asset and a liability for their operating leases. Rent also impacts the balance sheet in the context of lease accounting. Rent expense is not reported on the balance sheet. Rent expense on the balance sheet. Learn how to accurately account for rent expenses in financial statements and understand their impact.

ASC 842 Balance Sheet Guide with Examples Visual Lease

In short, organizations will now have to record both an asset and a liability for their operating leases. Rent expense is not reported on the balance sheet. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent expense on the balance sheet. Rent also impacts the balance sheet in.

Putting rented assets on a company's balance sheet is long overdue

Rent expense is not reported on the balance sheet. It is still only reported on the income statement. In short, expenses appear directly in the income statement and indirectly in the balance sheet. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent expense on the balance sheet.

ASC 842 Summary of Balance Sheet Changes for 2020

In short, expenses appear directly in the income statement and indirectly in the balance sheet. Rent expense on the balance sheet. It is still only reported on the income statement. It is useful to always read both. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax.

The Balance Sheet A Howto Guide for Businesses

Rent expense on the balance sheet. It is still only reported on the income statement. Under standards like ifrs 16 and asc 842, companies. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent expense is not reported on the balance sheet.

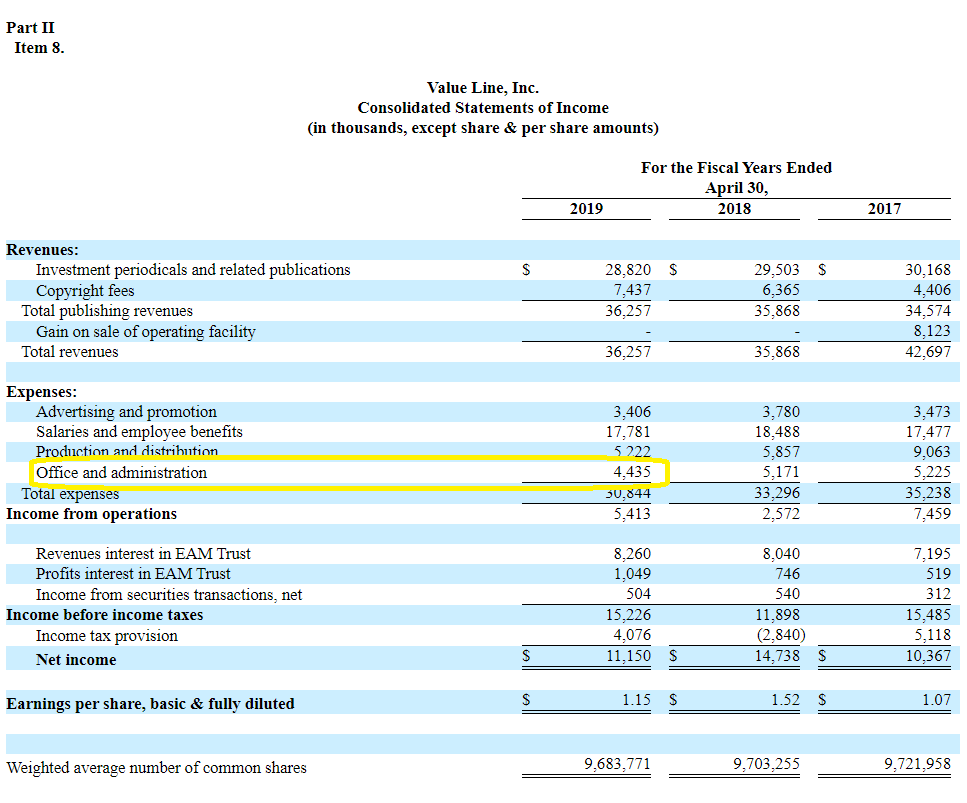

The Potential Impact of Lease Accounting on Equity Valuation The CPA

Rent also impacts the balance sheet in the context of lease accounting. In short, expenses appear directly in the income statement and indirectly in the balance sheet. It is useful to always read both. It is still only reported on the income statement. In short, organizations will now have to record both an asset and a liability for their operating.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Under standards like ifrs 16 and asc 842, companies. In short, organizations will now have to record both an asset and a liability for their operating leases. It is useful to always read both. Rent also impacts the balance sheet in the context of lease accounting. Learn how to accurately account for rent expenses in financial statements and understand their.

In Short, Expenses Appear Directly In The Income Statement And Indirectly In The Balance Sheet.

In short, organizations will now have to record both an asset and a liability for their operating leases. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Under standards like ifrs 16 and asc 842, companies. Rent expense on the balance sheet.

Rent Also Impacts The Balance Sheet In The Context Of Lease Accounting.

It is still only reported on the income statement. It is useful to always read both. Rent expense is not reported on the balance sheet.