Debt Investment On Balance Sheet - When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. For investors, understanding how these debts appear on a balance sheet is vital for assessing a company’s overall financial stability. The company can make the journal entry for debt investment by debiting the debt investments account and crediting the cash account.

The company can make the journal entry for debt investment by debiting the debt investments account and crediting the cash account. For investors, understanding how these debts appear on a balance sheet is vital for assessing a company’s overall financial stability. When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance.

When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. The company can make the journal entry for debt investment by debiting the debt investments account and crediting the cash account. For investors, understanding how these debts appear on a balance sheet is vital for assessing a company’s overall financial stability.

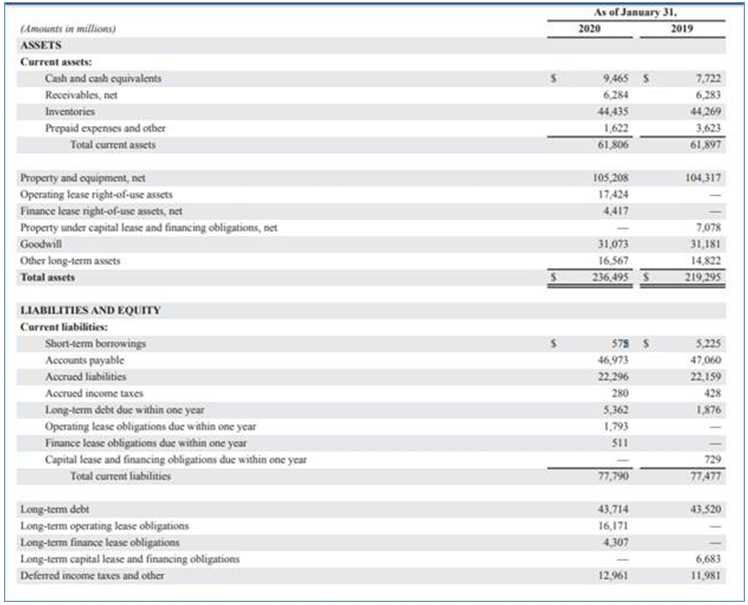

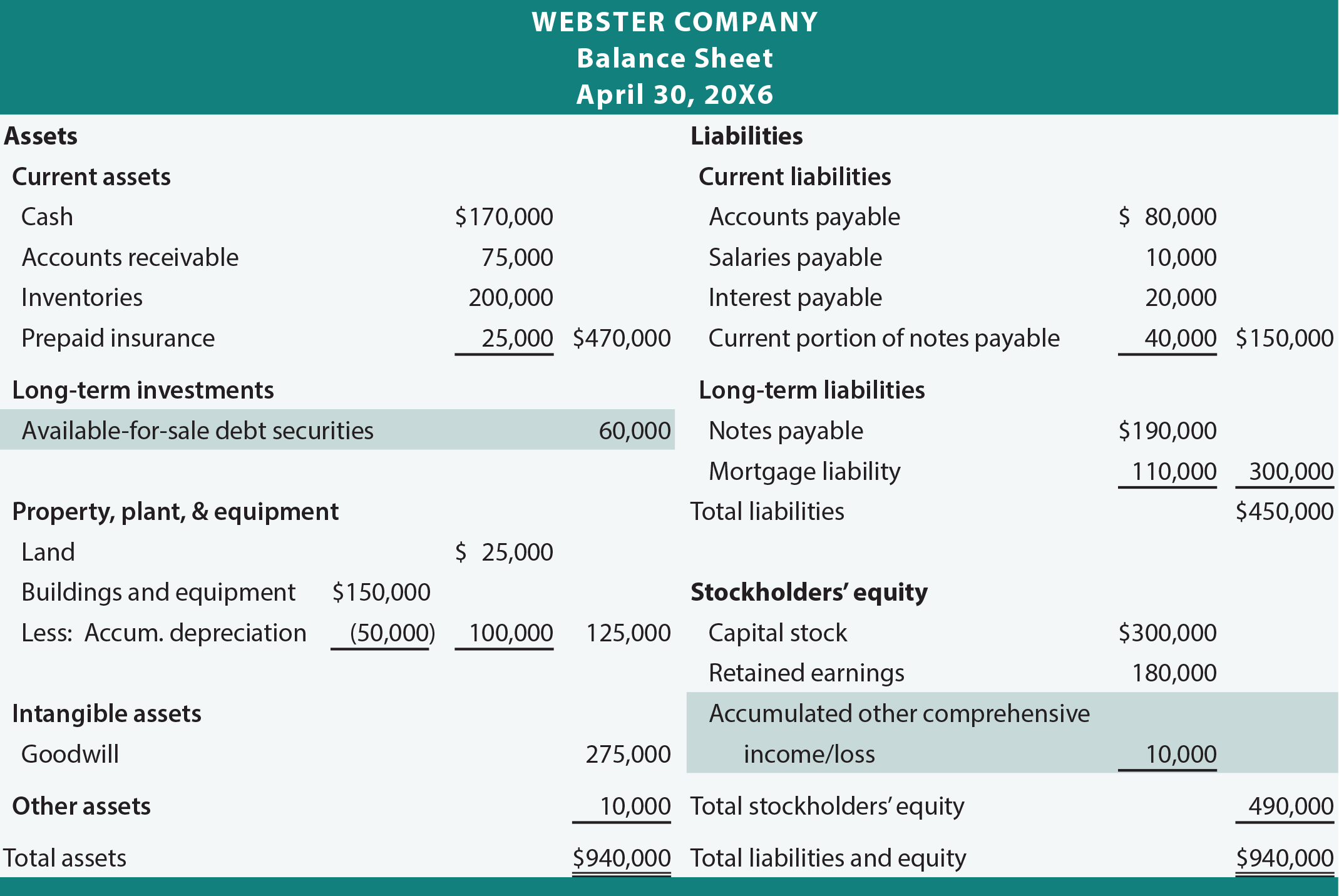

Long Term Debt in Balance Sheet and Examples

For investors, understanding how these debts appear on a balance sheet is vital for assessing a company’s overall financial stability. When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. The company can make the journal entry for debt investment by debiting the debt investments.

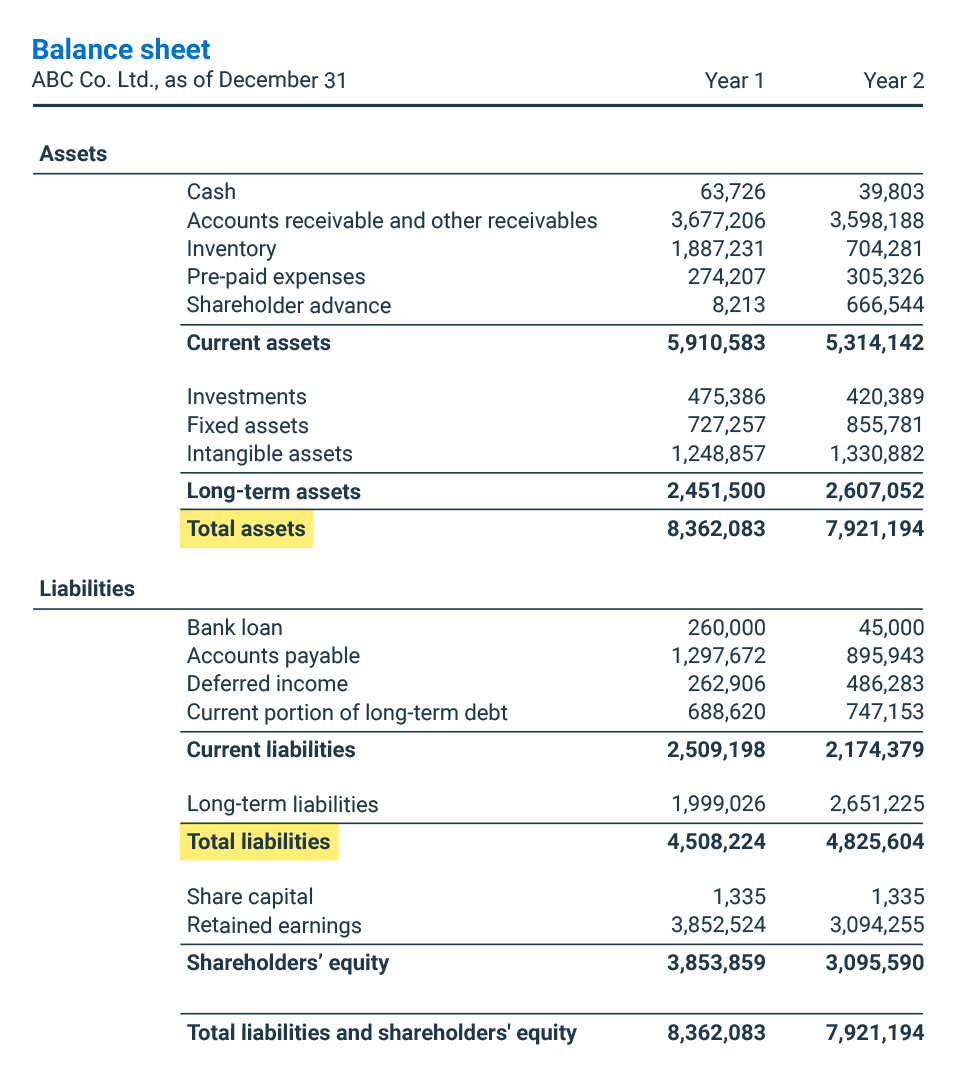

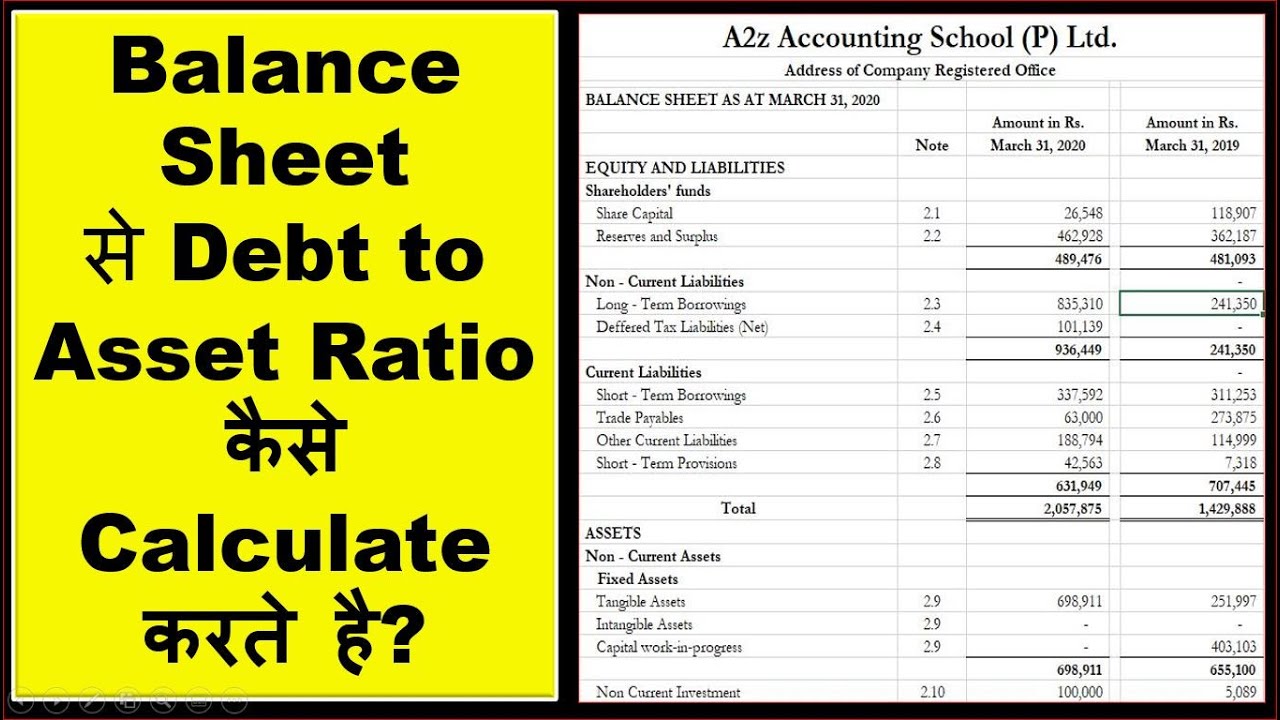

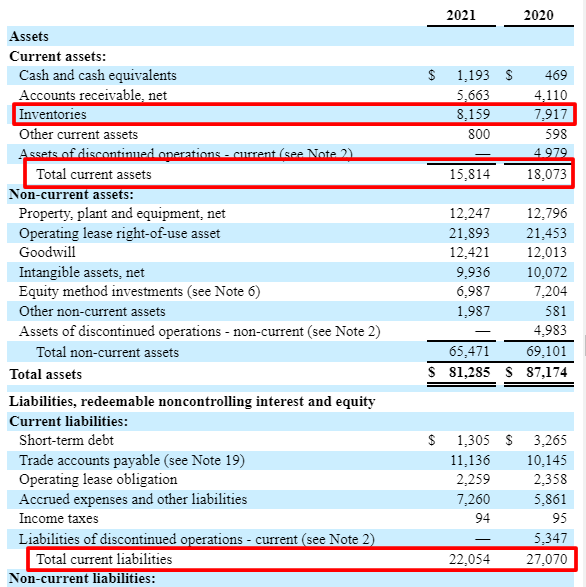

Debttoasset ratio calculator BDC.ca

For investors, understanding how these debts appear on a balance sheet is vital for assessing a company’s overall financial stability. When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. The company can make the journal entry for debt investment by debiting the debt investments.

How To Find Debt Ratio On Balance Sheet at Michelle Morales blog

When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. The company can make the journal entry for debt investment by debiting the debt investments account and crediting the cash account. For investors, understanding how these debts appear on a balance sheet is vital for.

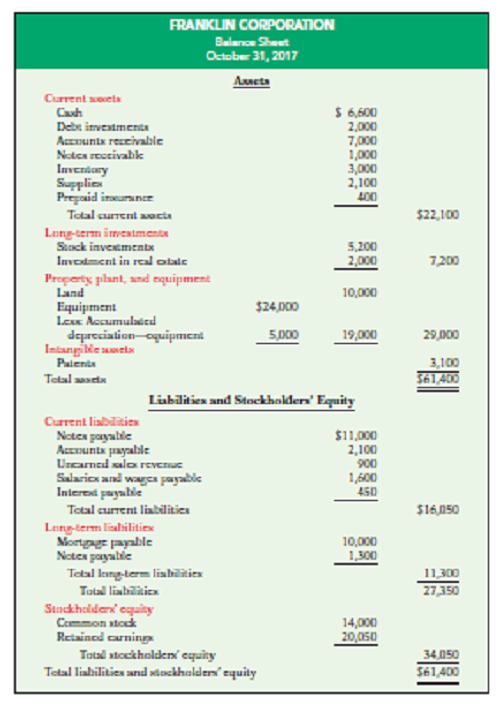

Favorite Debt Investments Balance Sheet Classification Forecasting Items

When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. The company can make the journal entry for debt investment by debiting the debt investments account and crediting the cash account. For investors, understanding how these debts appear on a balance sheet is vital for.

How to Calculate Debt from Balance Sheet? in 2022 Balance sheet

The company can make the journal entry for debt investment by debiting the debt investments account and crediting the cash account. When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. For investors, understanding how these debts appear on a balance sheet is vital for.

Debt Securities

For investors, understanding how these debts appear on a balance sheet is vital for assessing a company’s overall financial stability. When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. The company can make the journal entry for debt investment by debiting the debt investments.

Liabilities Side of Balance Sheet

For investors, understanding how these debts appear on a balance sheet is vital for assessing a company’s overall financial stability. The company can make the journal entry for debt investment by debiting the debt investments account and crediting the cash account. When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized.

ShortTerm Debt Evaluating Financial Strength and CashGenerating Growth

When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. The company can make the journal entry for debt investment by debiting the debt investments account and crediting the cash account. For investors, understanding how these debts appear on a balance sheet is vital for.

Balance Sheet Basics Accounting Education

The company can make the journal entry for debt investment by debiting the debt investments account and crediting the cash account. When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. For investors, understanding how these debts appear on a balance sheet is vital for.

Pin on diy

For investors, understanding how these debts appear on a balance sheet is vital for assessing a company’s overall financial stability. When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. The company can make the journal entry for debt investment by debiting the debt investments.

The Company Can Make The Journal Entry For Debt Investment By Debiting The Debt Investments Account And Crediting The Cash Account.

When a reporting entity acquires a debt security, it should be classified into one of three categories and recognized as an asset on the balance. For investors, understanding how these debts appear on a balance sheet is vital for assessing a company’s overall financial stability.