Cogs On Balance Sheet - Cogs is an important metric to track in improving profitability. By understanding cogs, you can explore strategies, such as reducing. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current.

Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. By understanding cogs, you can explore strategies, such as reducing. Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current.

Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. By understanding cogs, you can explore strategies, such as reducing.

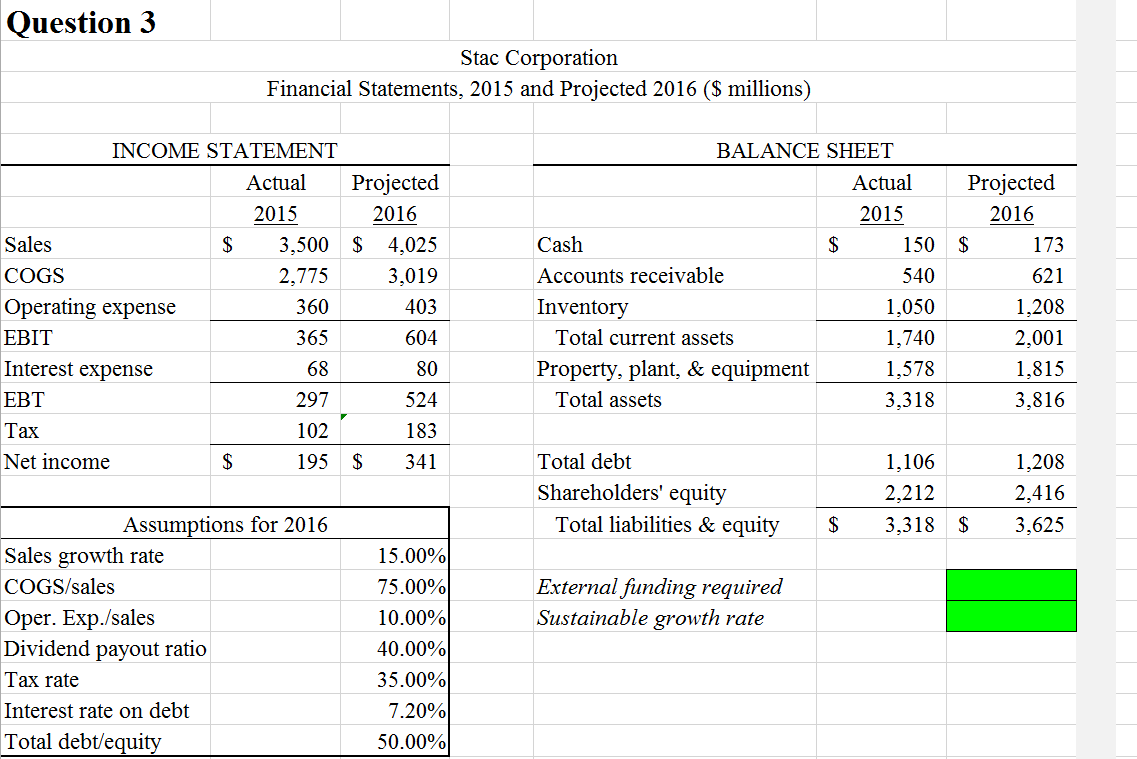

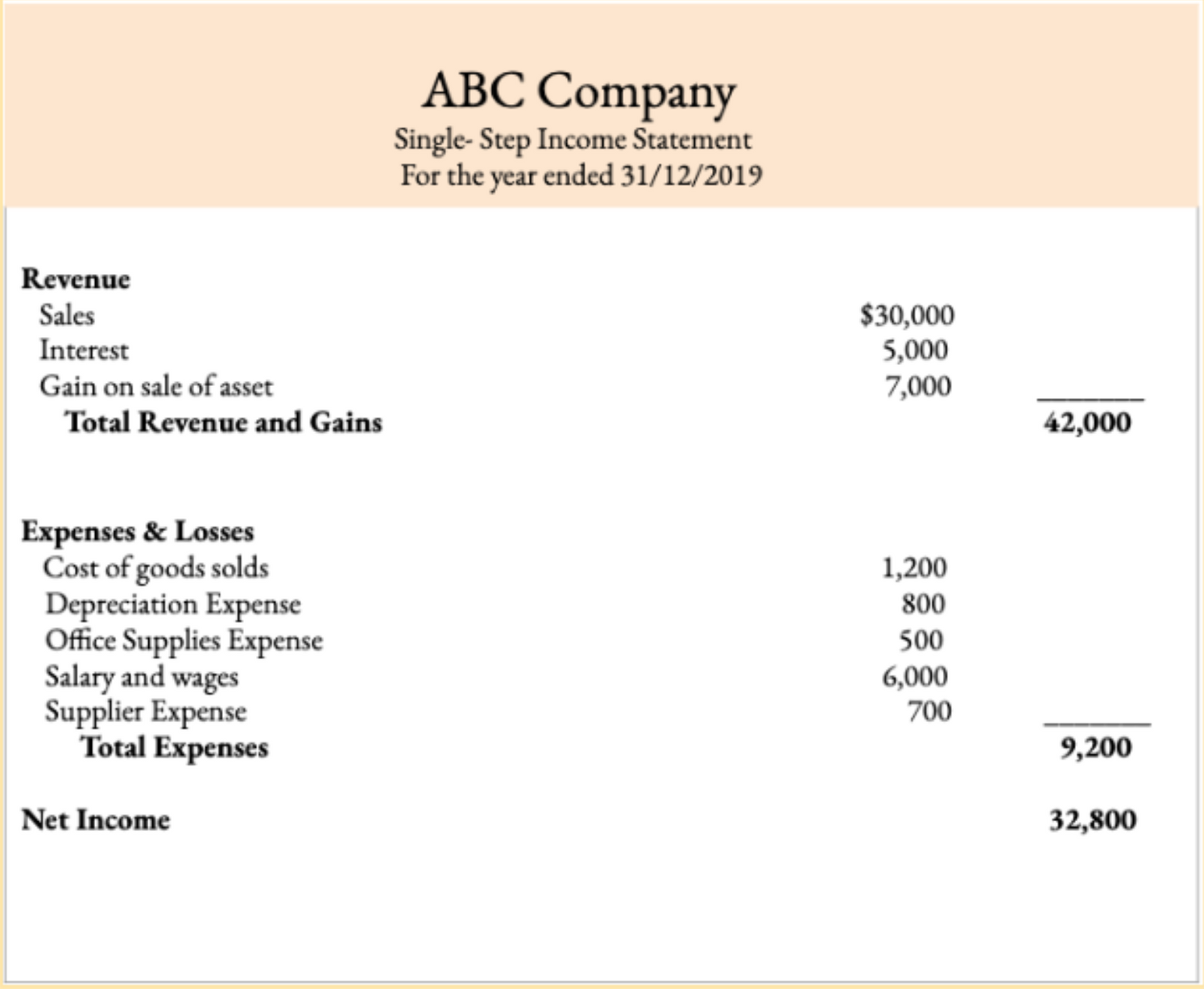

How To Calculate Cogs From Statement Haiper

The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. Cogs is an important metric to track in improving profitability. By understanding cogs, you can.

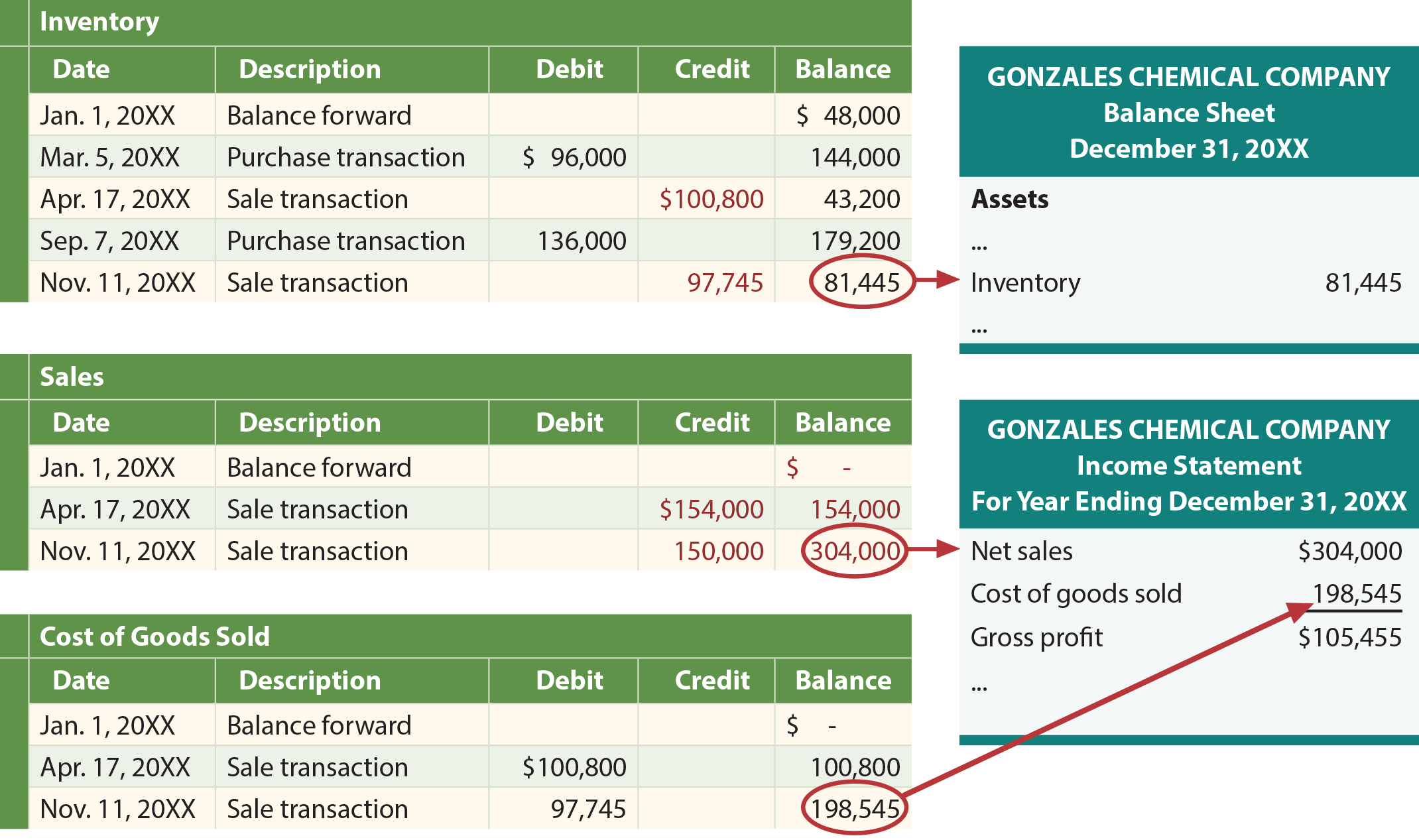

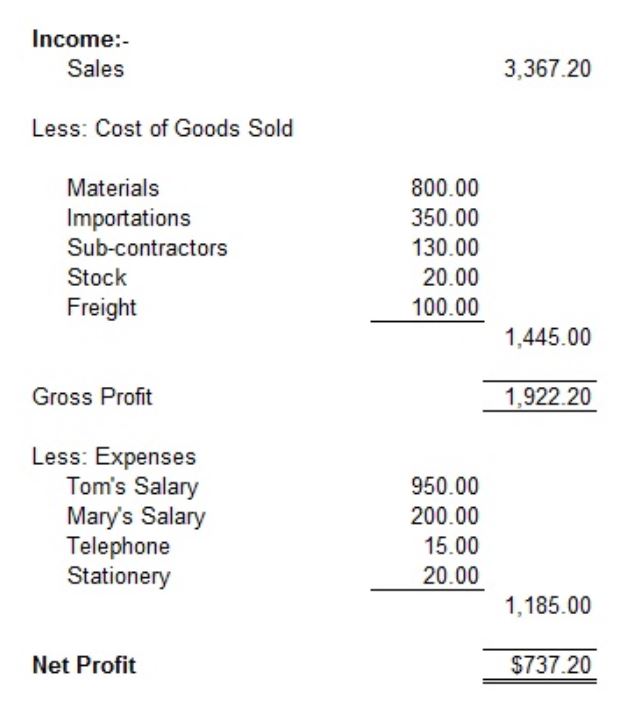

What does COGS mean on a balance sheet? Leia aqui What is COGS on a

Cogs is an important metric to track in improving profitability. By understanding cogs, you can explore strategies, such as reducing. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to.

How to Calculate Budgeted Cost of Goods Sold Accounting Education

Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. By understanding cogs, you can explore strategies, such as reducing. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to.

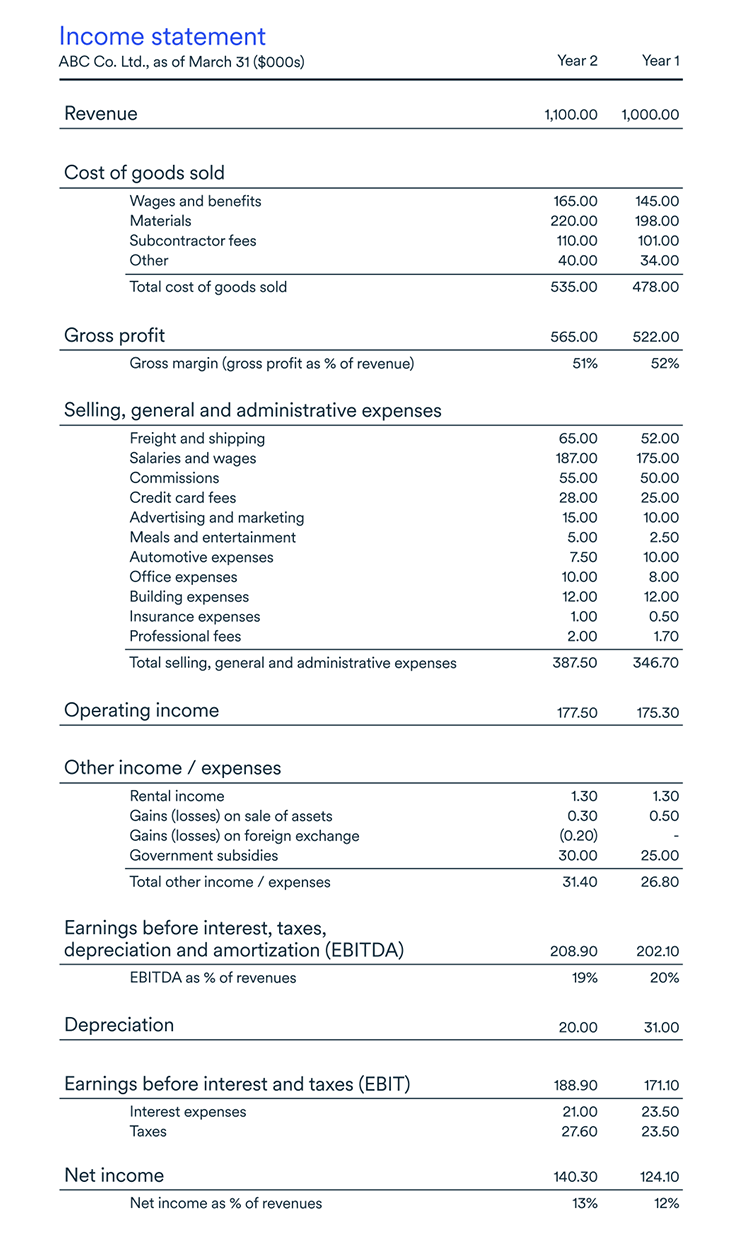

What is the cost of goods sold (COGS) BDC.ca

Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. By understanding cogs, you can explore strategies, such as reducing. Cogs is an important metric.

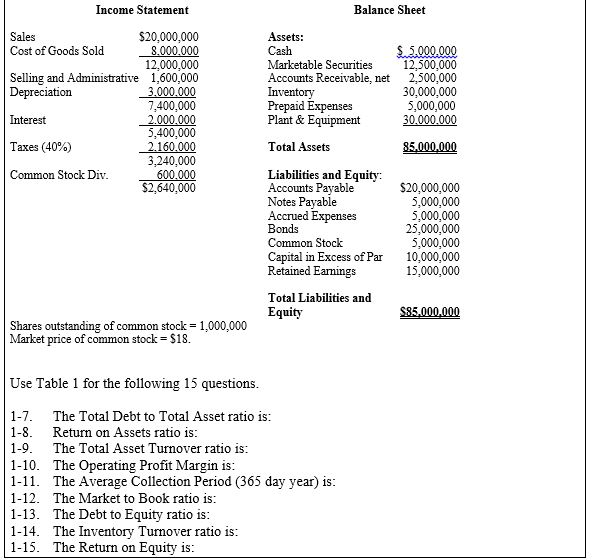

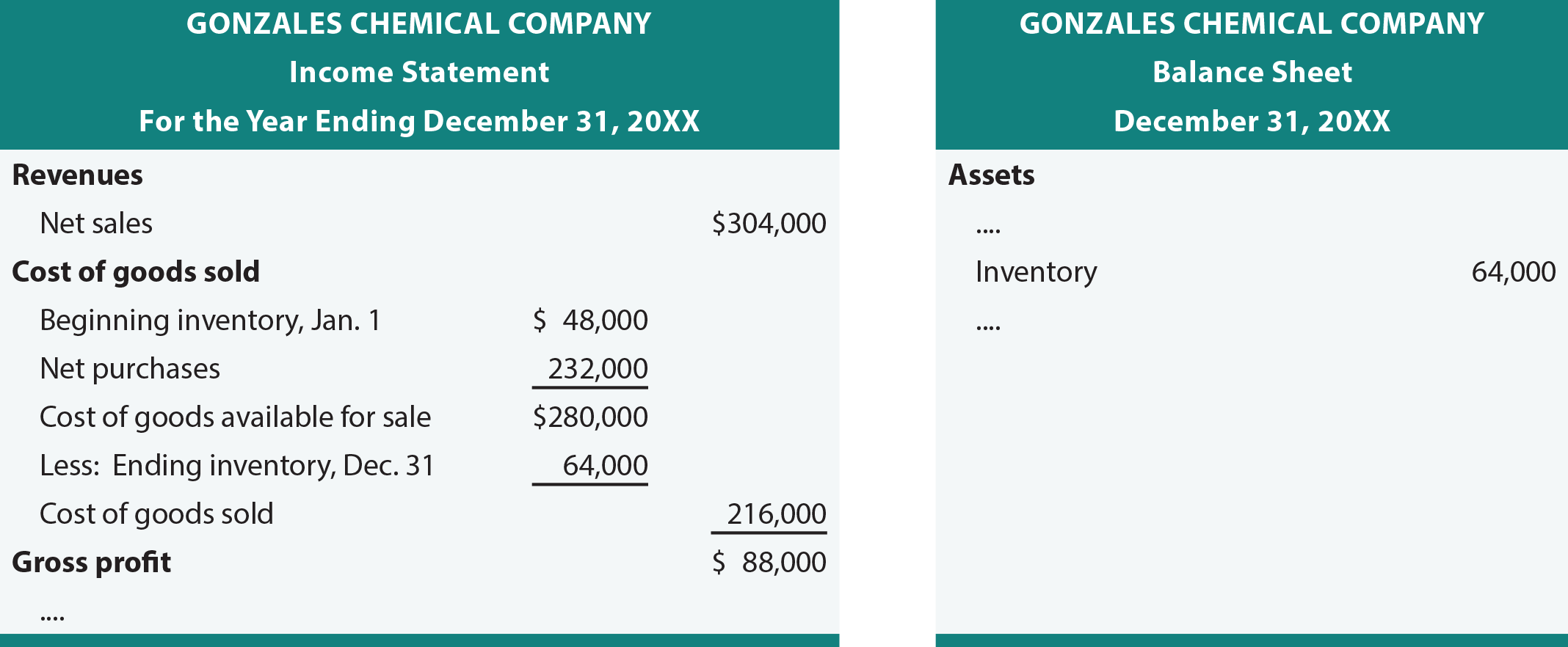

Solved Statement Balance Sheet Sales Cost of Goods

The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. Cogs is an important metric to track in improving profitability. By understanding cogs, you can.

What Is Cost of Goods Sold (COGS)? Definition, Calculation, Examples

The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cogs is an important metric to track in improving profitability. By understanding cogs, you can explore strategies, such as reducing. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

Cogs is an important metric to track in improving profitability. By understanding cogs, you can explore strategies, such as reducing. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to.

Calculate Cost of Goods Sold Learn How

By understanding cogs, you can explore strategies, such as reducing. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. Cogs is an important metric.

Inventory Costing Methods

Cogs is an important metric to track in improving profitability. By understanding cogs, you can explore strategies, such as reducing. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to.

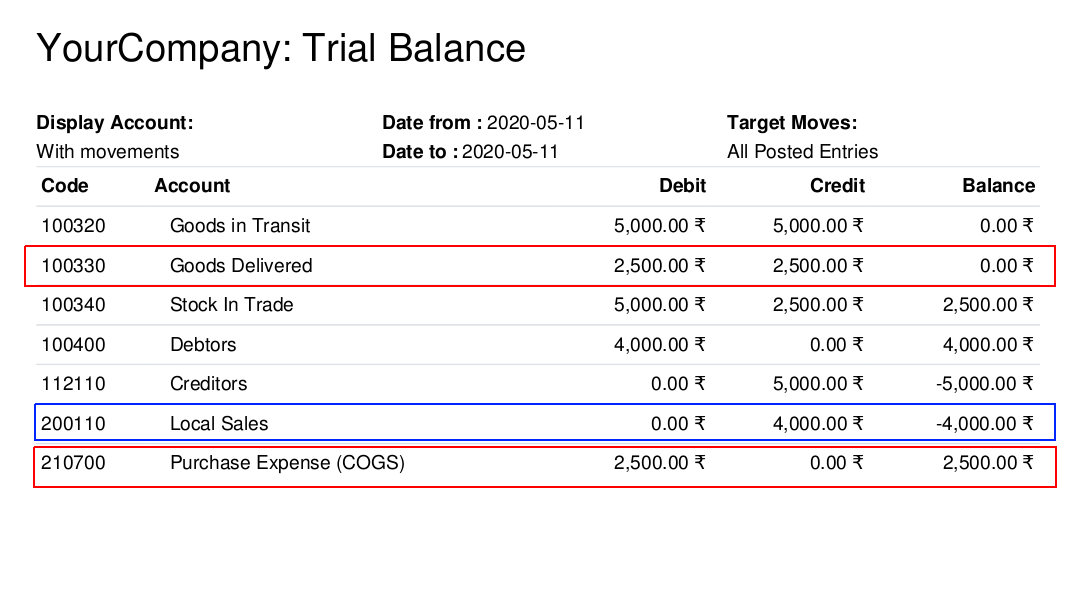

Cost of goods sold (COGS) using AngloSaxon Accounting BroadTech IT

By understanding cogs, you can explore strategies, such as reducing. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance.

Cogs Is An Important Metric To Track In Improving Profitability.

By understanding cogs, you can explore strategies, such as reducing. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current.