Clearbridge Aggressive Growth Fund Fact Sheet - The fund invests primarily in common stocks of companies the portfolio managers believe are experiencing, or will experience, growth in. Patient management seeks capital appreciation from a. The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. This fund meets the requirements under article 8 of the eu sustainable finance disclosure regulation (sfdr); The fund invests at least 70% of its net asset value in common. Seeks to invest in companies across capitalizations with high growth potential.

Patient management seeks capital appreciation from a. This fund meets the requirements under article 8 of the eu sustainable finance disclosure regulation (sfdr); The fund invests at least 70% of its net asset value in common. The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. The fund invests primarily in common stocks of companies the portfolio managers believe are experiencing, or will experience, growth in. Seeks to invest in companies across capitalizations with high growth potential.

The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. This fund meets the requirements under article 8 of the eu sustainable finance disclosure regulation (sfdr); The fund invests primarily in common stocks of companies the portfolio managers believe are experiencing, or will experience, growth in. Seeks to invest in companies across capitalizations with high growth potential. Patient management seeks capital appreciation from a. The fund invests at least 70% of its net asset value in common.

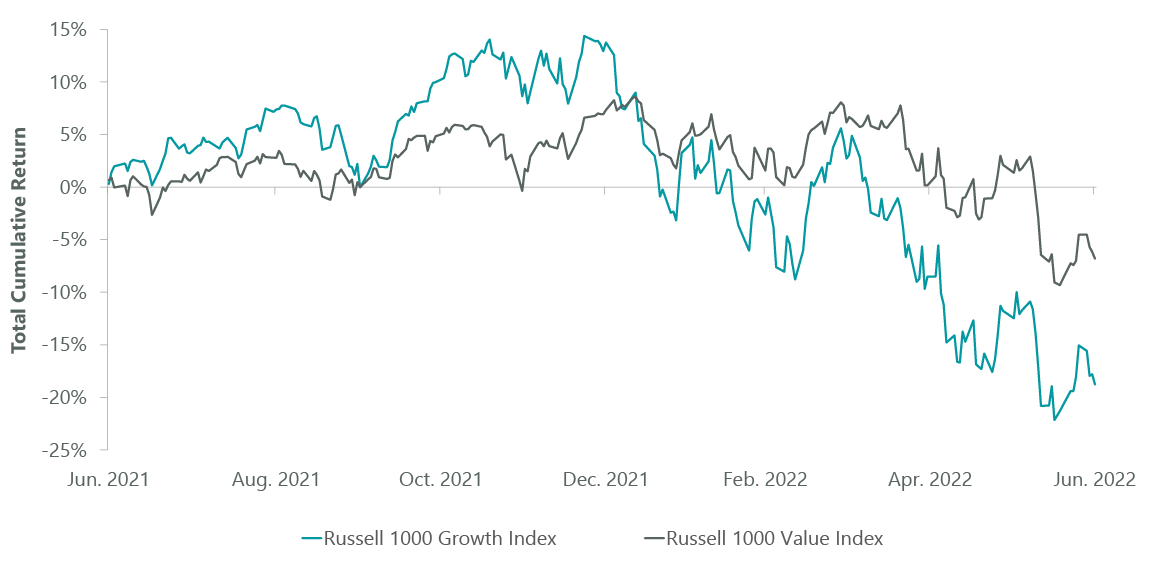

ClearBridge Aggressive Growth Strategy Portfolio Manager Commentary Q1

This fund meets the requirements under article 8 of the eu sustainable finance disclosure regulation (sfdr); The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. Seeks to invest in companies across capitalizations with high growth potential. The fund invests primarily in common stocks of companies the portfolio managers believe.

ClearBridge Aggressive Growth Strategy Portfolio Manager Commentary Q2

Patient management seeks capital appreciation from a. The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. This fund meets the requirements under article 8 of the eu sustainable finance disclosure regulation (sfdr); The fund invests at least 70% of its net asset value in common. Seeks to invest in.

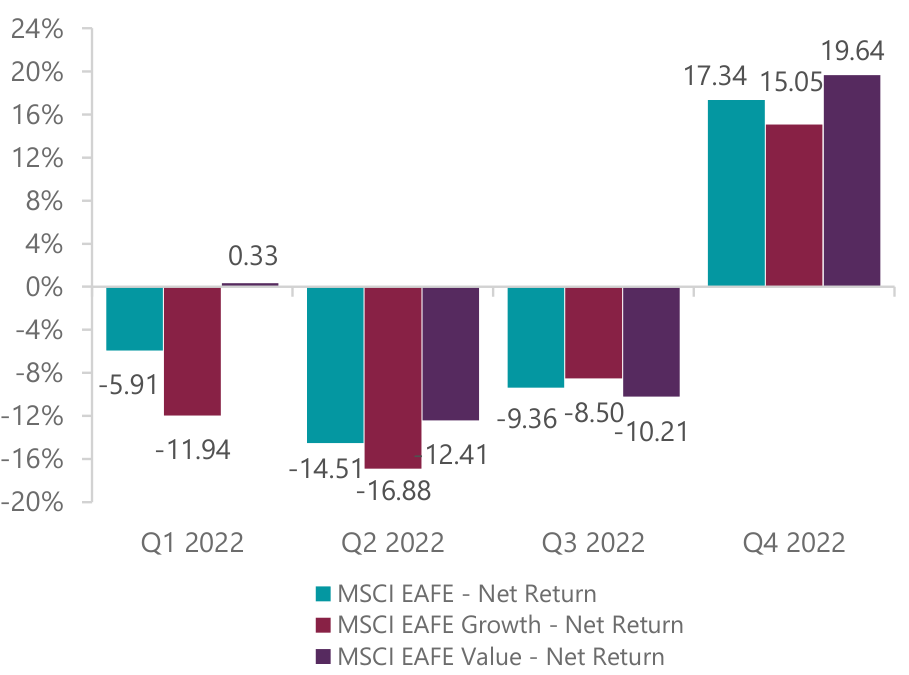

ClearBridge Aggressive Growth Strategy Q4 2022 Portfolio Manager

This fund meets the requirements under article 8 of the eu sustainable finance disclosure regulation (sfdr); Patient management seeks capital appreciation from a. Seeks to invest in companies across capitalizations with high growth potential. The fund invests at least 70% of its net asset value in common. The fund invests primarily in common stocks of companies the portfolio managers believe.

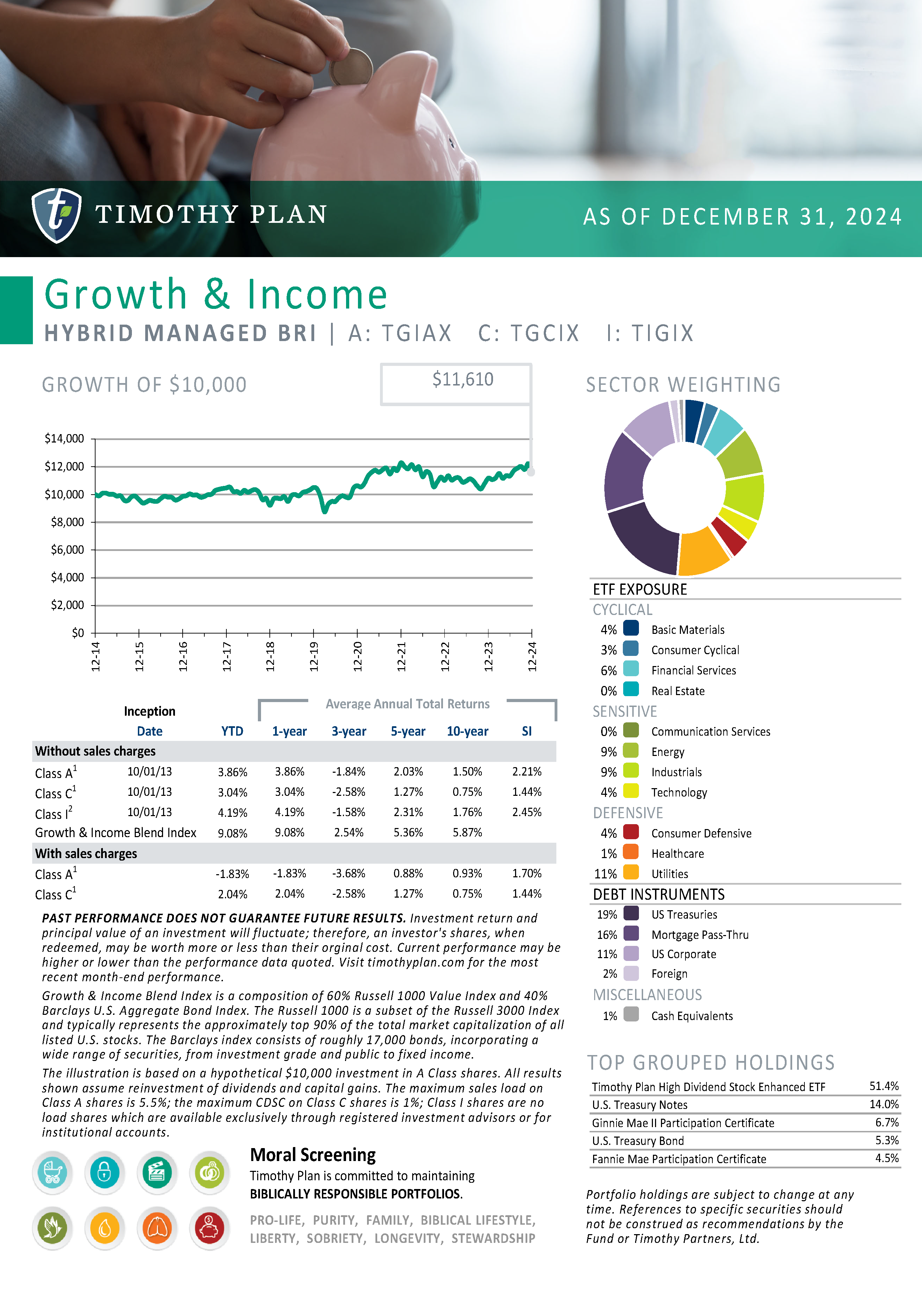

Timothy Plan® Performance of the Funds

This fund meets the requirements under article 8 of the eu sustainable finance disclosure regulation (sfdr); The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. Patient management seeks capital appreciation from a. The fund invests primarily in common stocks of companies the portfolio managers believe are experiencing, or will.

Old Mutual Balanced Fund PDF Investing Bonds (Finance)

The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. The fund invests primarily in common stocks of companies the portfolio managers believe are experiencing, or will experience, growth in. Patient management seeks capital appreciation from a. The fund invests at least 70% of its net asset value in common..

Clearbridge Appreciation Fund Fact Sheet Printable Templates Free

The fund invests primarily in common stocks of companies the portfolio managers believe are experiencing, or will experience, growth in. Patient management seeks capital appreciation from a. This fund meets the requirements under article 8 of the eu sustainable finance disclosure regulation (sfdr); Seeks to invest in companies across capitalizations with high growth potential. The fund seeks capital appreciation by.

FTGF ClearBridge US Aggressive Growth A USD DIS

This fund meets the requirements under article 8 of the eu sustainable finance disclosure regulation (sfdr); Seeks to invest in companies across capitalizations with high growth potential. The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. The fund invests primarily in common stocks of companies the portfolio managers believe.

ClearBridge Aggressive Growth Strategy Portfolio Manager Commentary Q2

The fund invests at least 70% of its net asset value in common. Seeks to invest in companies across capitalizations with high growth potential. Patient management seeks capital appreciation from a. The fund invests primarily in common stocks of companies the portfolio managers believe are experiencing, or will experience, growth in. This fund meets the requirements under article 8 of.

Franklin Templeton International Services S.à r.l. Fonds • FTGF

Patient management seeks capital appreciation from a. The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. This fund meets the requirements under article 8 of the eu sustainable finance disclosure regulation (sfdr); The fund invests at least 70% of its net asset value in common. Seeks to invest in.

ClearBridge Aggressive Growth Strategy Portfolio Manager Commentary Q1

The fund invests primarily in common stocks of companies the portfolio managers believe are experiencing, or will experience, growth in. The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. The fund invests at least 70% of its net asset value in common. Seeks to invest in companies across capitalizations.

Patient Management Seeks Capital Appreciation From A.

The fund seeks capital appreciation by primarily investing in common stocks of companies the portfolio managers believe are experiencing, or. Seeks to invest in companies across capitalizations with high growth potential. The fund invests at least 70% of its net asset value in common. The fund invests primarily in common stocks of companies the portfolio managers believe are experiencing, or will experience, growth in.