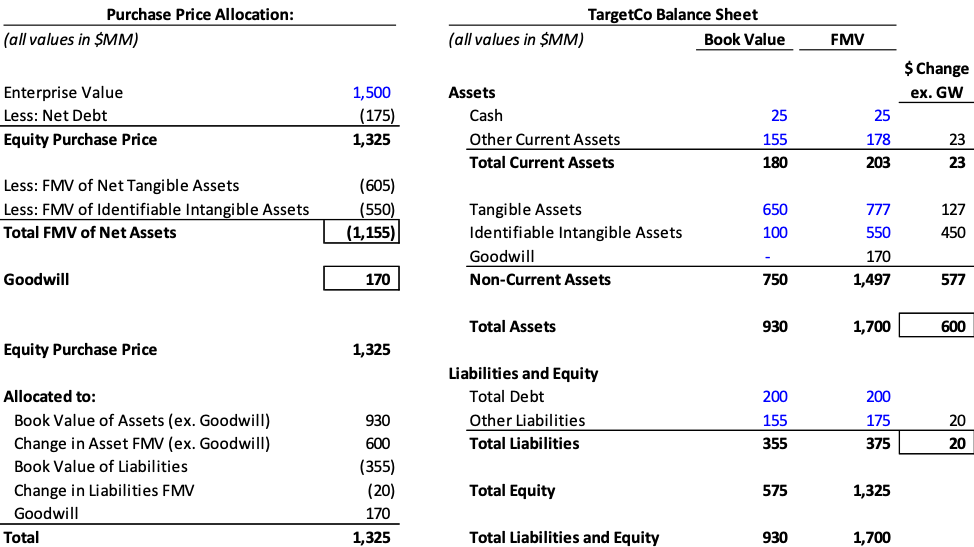

Balance Sheet Goodwill - In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the. Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. Guide to goodwill and its definition. We explain how to calculate it, its impairment,. Goodwill is calculated by subtracting the fair market value of a. Learn how to calculate goodwill, its. How is goodwill calculated and recorded on a balance sheet?

Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. Guide to goodwill and its definition. In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the. Goodwill is calculated by subtracting the fair market value of a. We explain how to calculate it, its impairment,. How is goodwill calculated and recorded on a balance sheet? Learn how to calculate goodwill, its.

We explain how to calculate it, its impairment,. Goodwill is calculated by subtracting the fair market value of a. In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the. Learn how to calculate goodwill, its. How is goodwill calculated and recorded on a balance sheet? Guide to goodwill and its definition. Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business.

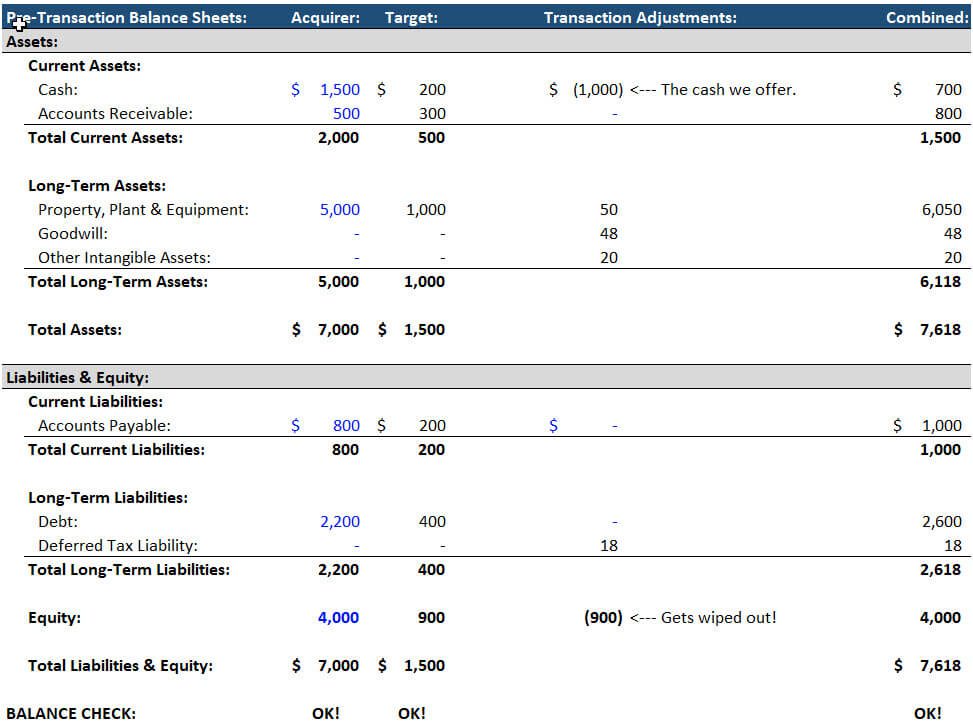

How to Calculate Goodwill Video Tutorial, Examples, and Excel Files

Learn how to calculate goodwill, its. How is goodwill calculated and recorded on a balance sheet? We explain how to calculate it, its impairment,. Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. Guide to goodwill and its definition.

Goodwill Overview, Examples, How Goodwill is Calculated

How is goodwill calculated and recorded on a balance sheet? Learn how to calculate goodwill, its. Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. Goodwill is calculated by subtracting the fair market value of a. In order to calculate goodwill, the fair market value of identifiable assets and.

How to Account for Goodwill A StepbyStep Accounting Guide

In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the. Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. Goodwill is calculated by subtracting the fair market value of a. How is goodwill calculated and recorded on.

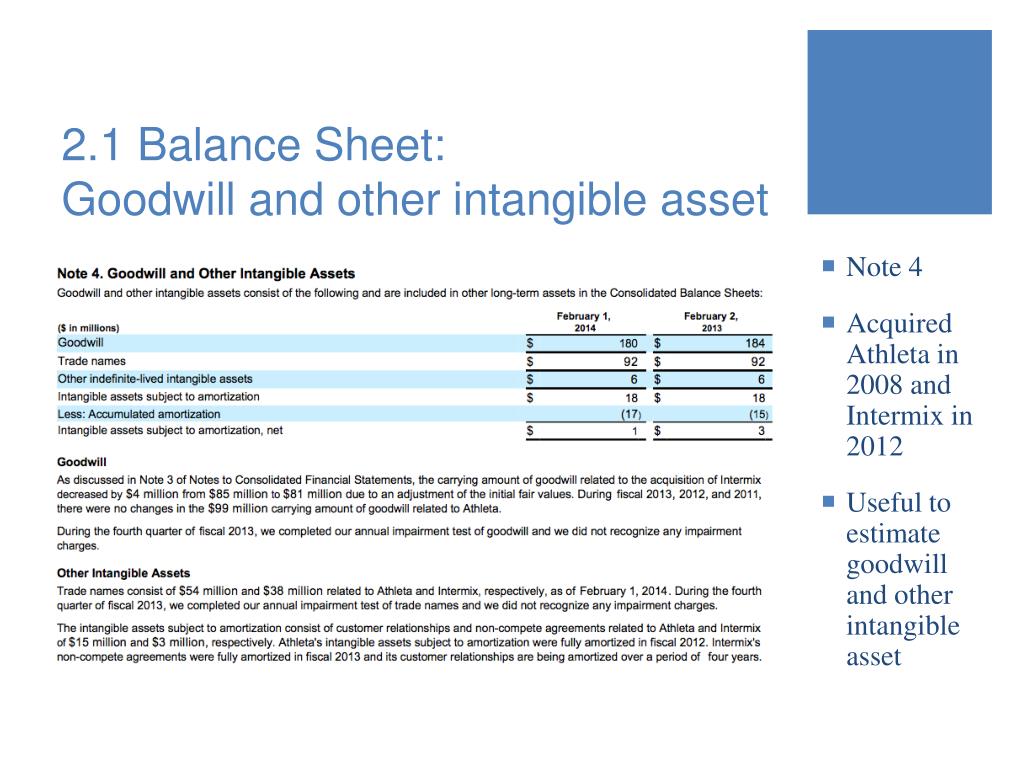

PPT Gap Inc. PowerPoint Presentation, free download ID1851791

We explain how to calculate it, its impairment,. In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the. Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. Goodwill is calculated by subtracting the fair market value of.

Goodwill in Finance Definition, Calculation, Formula

Guide to goodwill and its definition. How is goodwill calculated and recorded on a balance sheet? Goodwill is calculated by subtracting the fair market value of a. In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the. Goodwill is an intangible asset that occurs when a buyer pays.

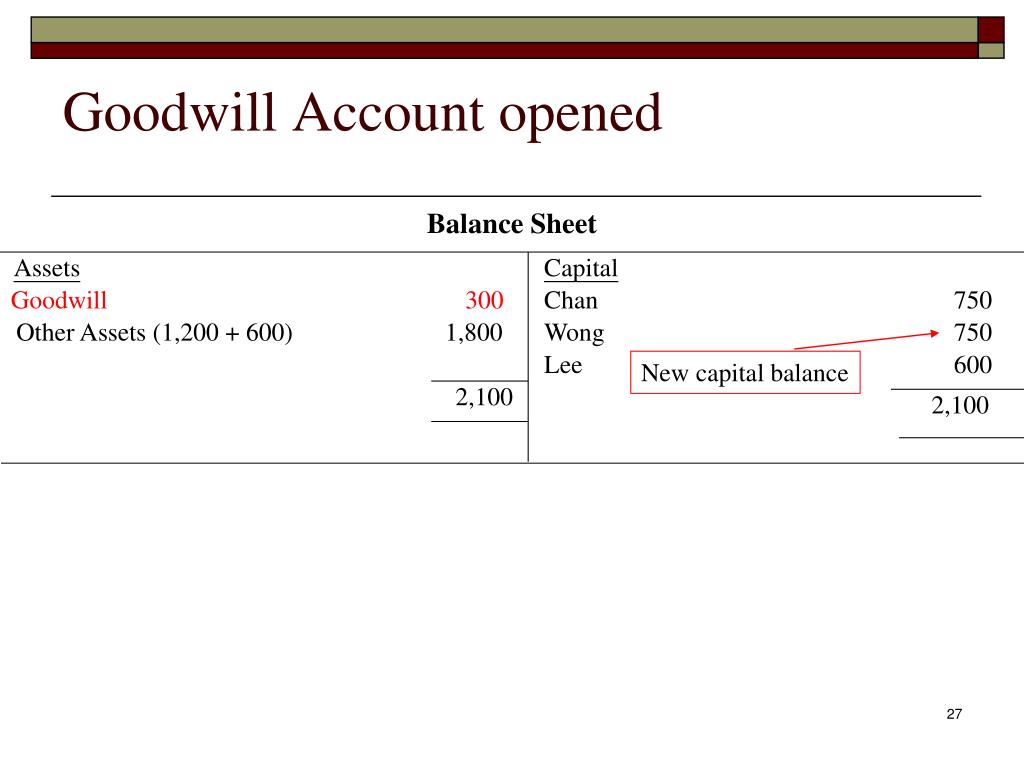

PPT “Goodwill Valuation” PowerPoint Presentation, free download ID

Guide to goodwill and its definition. Learn how to calculate goodwill, its. Goodwill is calculated by subtracting the fair market value of a. Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company.

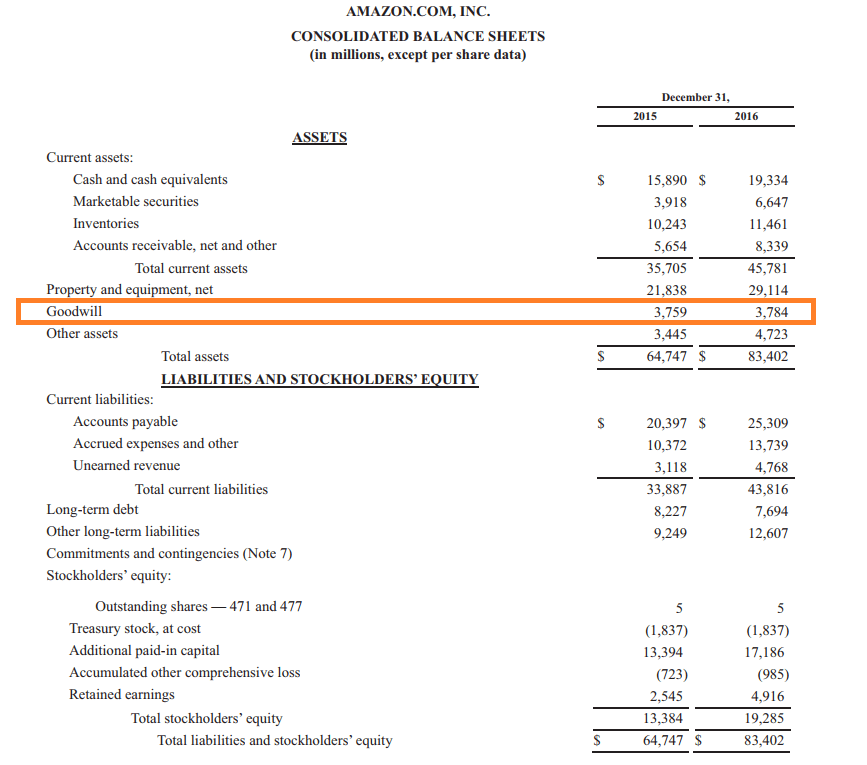

Goodwill Accounting

Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. Guide to goodwill and its definition. We explain how to calculate it, its impairment,. In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the. How is goodwill calculated.

Getting behind a balance sheet Investors' Chronicle

Goodwill is calculated by subtracting the fair market value of a. Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. How is goodwill calculated and recorded on a balance sheet? In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is.

Accounting Goodwill Analyzing a Balance Sheet Investing Post

Guide to goodwill and its definition. In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the. We explain how to calculate it, its impairment,. Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. Learn how to calculate.

PPT Northrop Grumman Corporation PowerPoint Presentation, free

In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the. Goodwill is an intangible asset that occurs when a buyer pays more than the fair market value of a business. Guide to goodwill and its definition. Learn how to calculate goodwill, its. Goodwill is calculated by subtracting the.

We Explain How To Calculate It, Its Impairment,.

How is goodwill calculated and recorded on a balance sheet? In order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the. Learn how to calculate goodwill, its. Goodwill is calculated by subtracting the fair market value of a.

Goodwill Is An Intangible Asset That Occurs When A Buyer Pays More Than The Fair Market Value Of A Business.

Guide to goodwill and its definition.