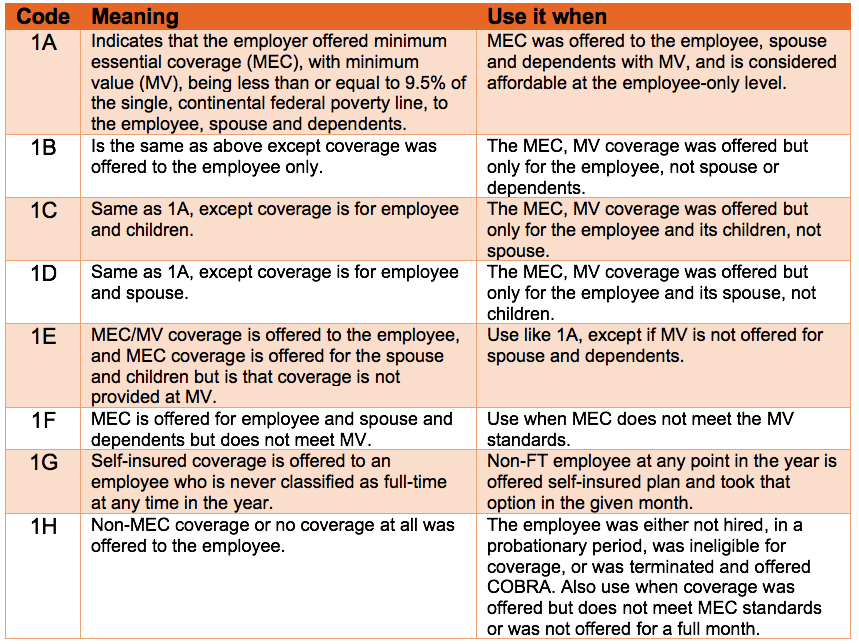

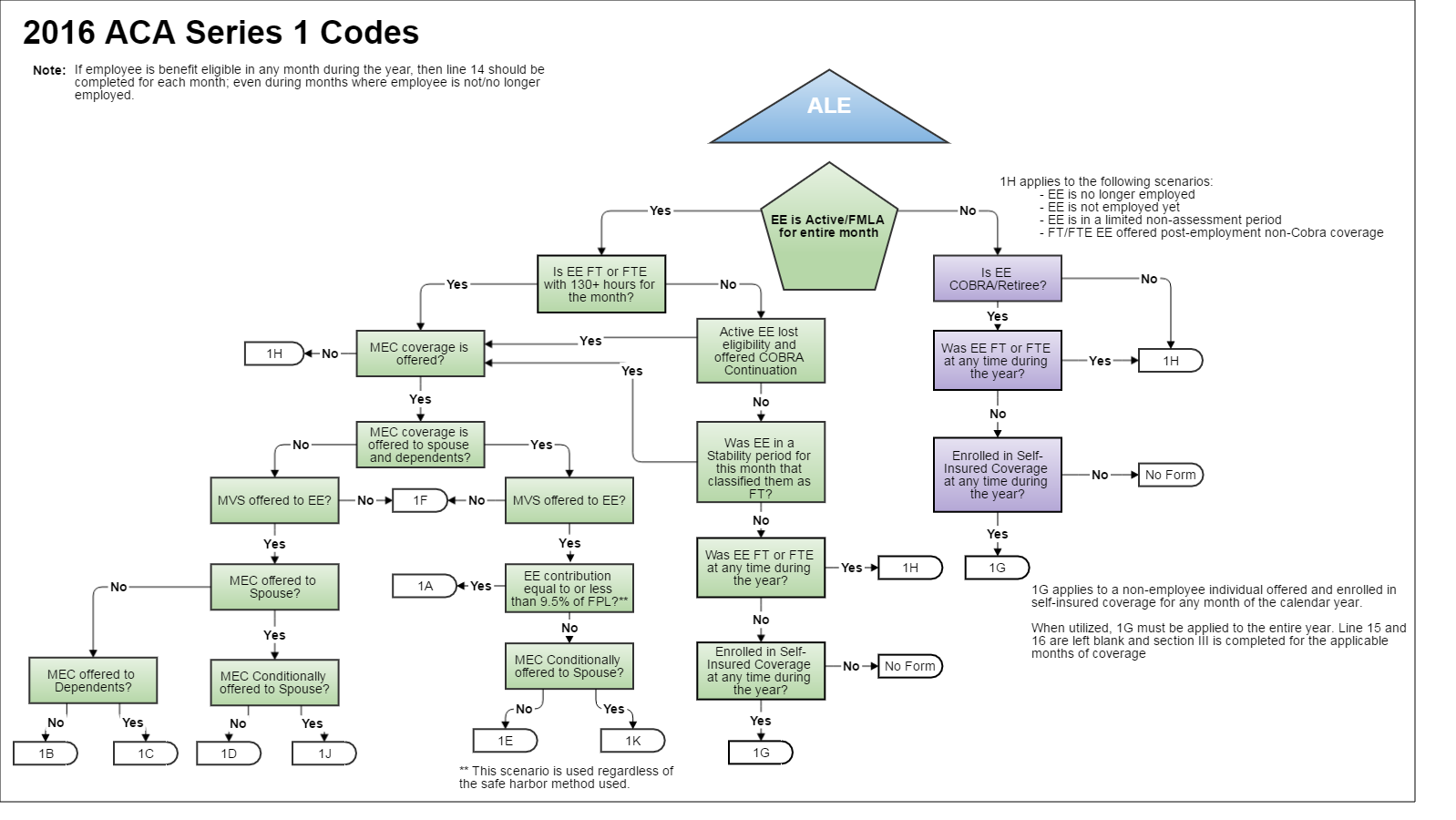

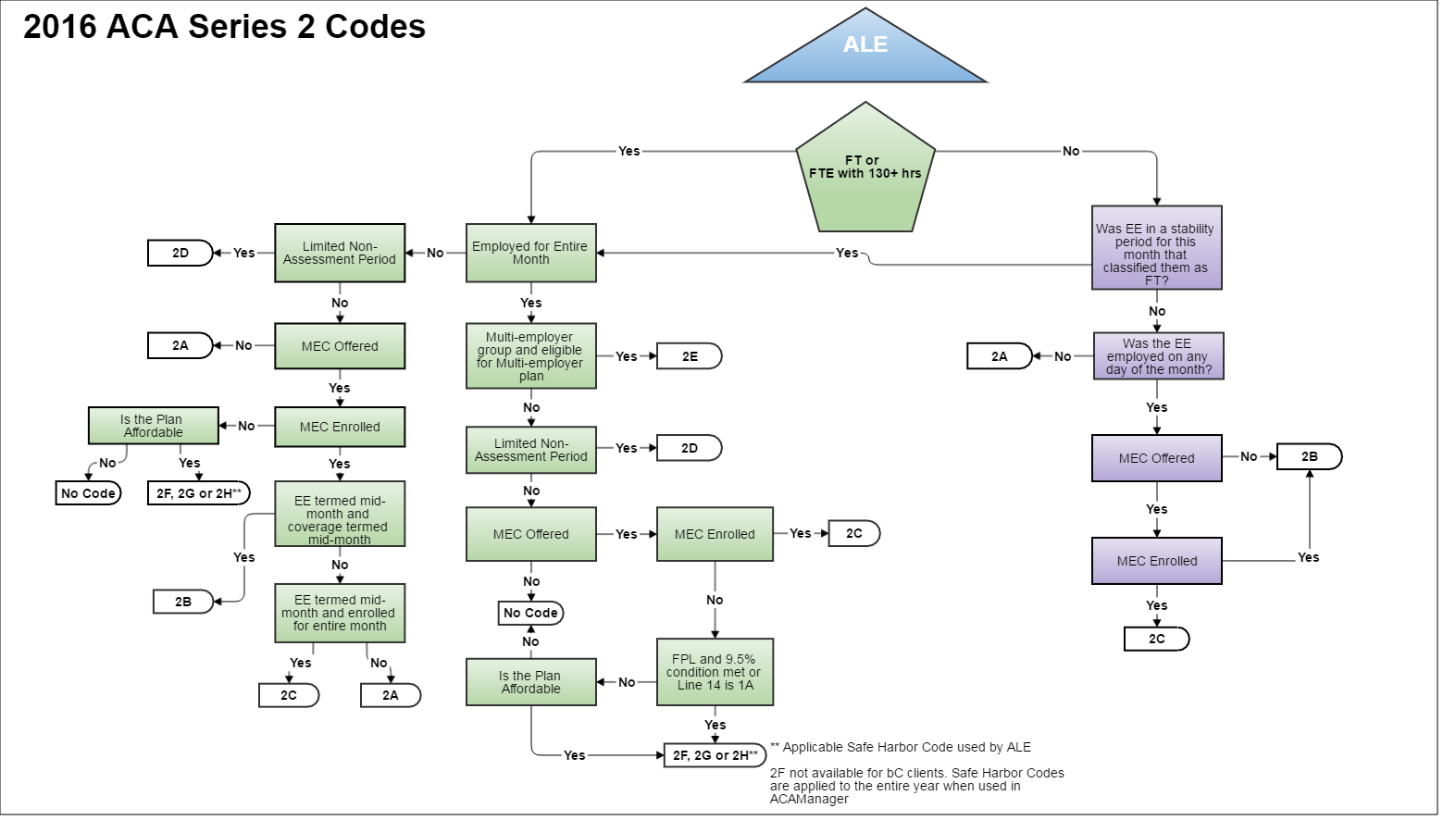

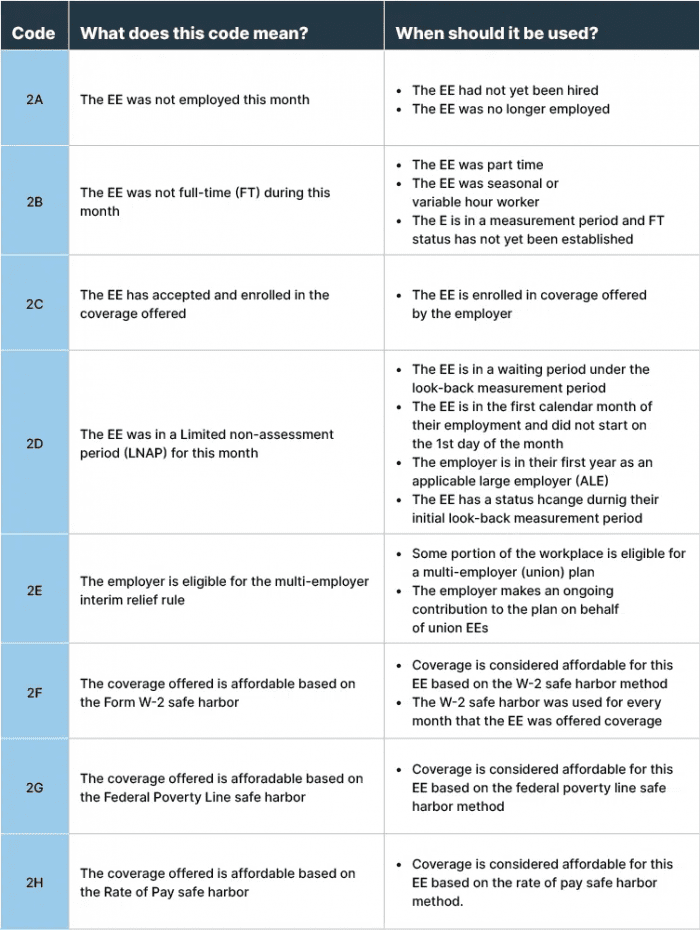

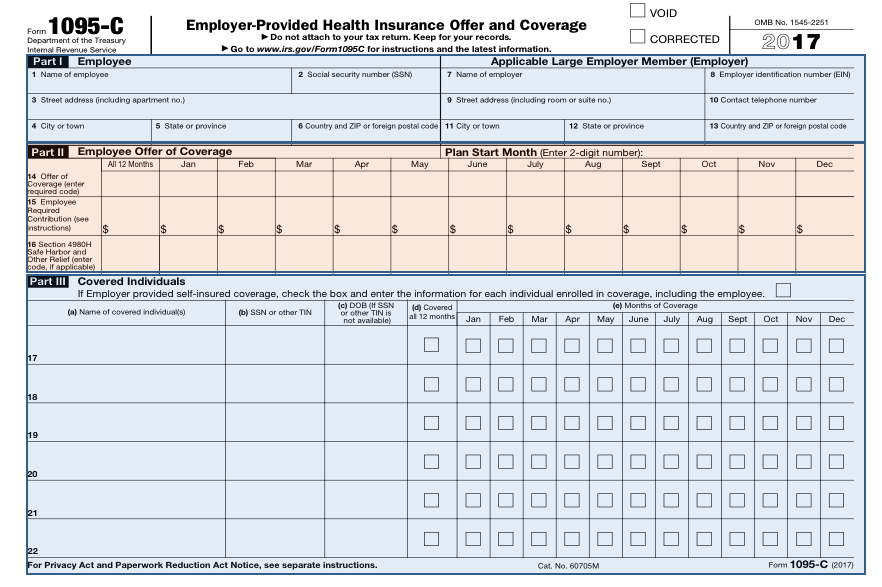

Aca Series Codes Cheat Sheet - We created this cheat sheet to help you address employee questions and understand your filing. The employee was not offered. ***code 1g applies to the entire year or not at all. This section uses two sets of codes released by the irs to help employers have. As part of the aca, the irs created two sets of. It is used to report the employee’s. If using code 1g, it must be entered in the all 12 months column.

This section uses two sets of codes released by the irs to help employers have. The employee was not offered. As part of the aca, the irs created two sets of. If using code 1g, it must be entered in the all 12 months column. It is used to report the employee’s. ***code 1g applies to the entire year or not at all. We created this cheat sheet to help you address employee questions and understand your filing.

***code 1g applies to the entire year or not at all. The employee was not offered. This section uses two sets of codes released by the irs to help employers have. As part of the aca, the irs created two sets of. If using code 1g, it must be entered in the all 12 months column. It is used to report the employee’s. We created this cheat sheet to help you address employee questions and understand your filing.

Aca Series Codes 2024 Berte Melonie

As part of the aca, the irs created two sets of. This section uses two sets of codes released by the irs to help employers have. We created this cheat sheet to help you address employee questions and understand your filing. The employee was not offered. If using code 1g, it must be entered in the all 12 months column.

ACA Codes A 1095 Cheat Sheet You're Gonna Love! Thread HCM

It is used to report the employee’s. This section uses two sets of codes released by the irs to help employers have. As part of the aca, the irs created two sets of. The employee was not offered. ***code 1g applies to the entire year or not at all.

ACA Code Cheatsheet

The employee was not offered. ***code 1g applies to the entire year or not at all. It is used to report the employee’s. As part of the aca, the irs created two sets of. This section uses two sets of codes released by the irs to help employers have.

ACA Codes a 1095Cheat Sheet You're Gonna love

We created this cheat sheet to help you address employee questions and understand your filing. ***code 1g applies to the entire year or not at all. The employee was not offered. If using code 1g, it must be entered in the all 12 months column. It is used to report the employee’s.

ACA Code Cheatsheet

As part of the aca, the irs created two sets of. It is used to report the employee’s. We created this cheat sheet to help you address employee questions and understand your filing. The employee was not offered. If using code 1g, it must be entered in the all 12 months column.

ACA Code Cheatsheet

It is used to report the employee’s. The employee was not offered. As part of the aca, the irs created two sets of. If using code 1g, it must be entered in the all 12 months column. ***code 1g applies to the entire year or not at all.

The Affordable Care Act (ACA) Code Cheat Sheet You Need Advantage

As part of the aca, the irs created two sets of. This section uses two sets of codes released by the irs to help employers have. ***code 1g applies to the entire year or not at all. The employee was not offered. It is used to report the employee’s.

ACA Codes A 1095 Cheat Sheet You're Gonna Love!

If using code 1g, it must be entered in the all 12 months column. As part of the aca, the irs created two sets of. It is used to report the employee’s. ***code 1g applies to the entire year or not at all. We created this cheat sheet to help you address employee questions and understand your filing.

ACA Codes a 1095Cheat Sheet You're Gonna love

As part of the aca, the irs created two sets of. This section uses two sets of codes released by the irs to help employers have. We created this cheat sheet to help you address employee questions and understand your filing. ***code 1g applies to the entire year or not at all. It is used to report the employee’s.

ACA Code Cheatsheet

As part of the aca, the irs created two sets of. ***code 1g applies to the entire year or not at all. This section uses two sets of codes released by the irs to help employers have. We created this cheat sheet to help you address employee questions and understand your filing. It is used to report the employee’s.

If Using Code 1G, It Must Be Entered In The All 12 Months Column.

It is used to report the employee’s. The employee was not offered. As part of the aca, the irs created two sets of. This section uses two sets of codes released by the irs to help employers have.

***Code 1G Applies To The Entire Year Or Not At All.

We created this cheat sheet to help you address employee questions and understand your filing.