A Tax Deferred Employee Benefit Is - Distributions from the plan are taxed as. As per chegg policy, i can answer first four parts. As described, defined benefit plans provide significant tax savings to both employers and employees.

Distributions from the plan are taxed as. As per chegg policy, i can answer first four parts. As described, defined benefit plans provide significant tax savings to both employers and employees.

Distributions from the plan are taxed as. As per chegg policy, i can answer first four parts. As described, defined benefit plans provide significant tax savings to both employers and employees.

Deferred Tax Liability astonishingceiyrs

As per chegg policy, i can answer first four parts. As described, defined benefit plans provide significant tax savings to both employers and employees. Distributions from the plan are taxed as.

Deferred Tax (DIT) Definition, Types and Examples Marketing91

As described, defined benefit plans provide significant tax savings to both employers and employees. As per chegg policy, i can answer first four parts. Distributions from the plan are taxed as.

Deferred Tax Deferred Tax in Accounting Standards

As described, defined benefit plans provide significant tax savings to both employers and employees. As per chegg policy, i can answer first four parts. Distributions from the plan are taxed as.

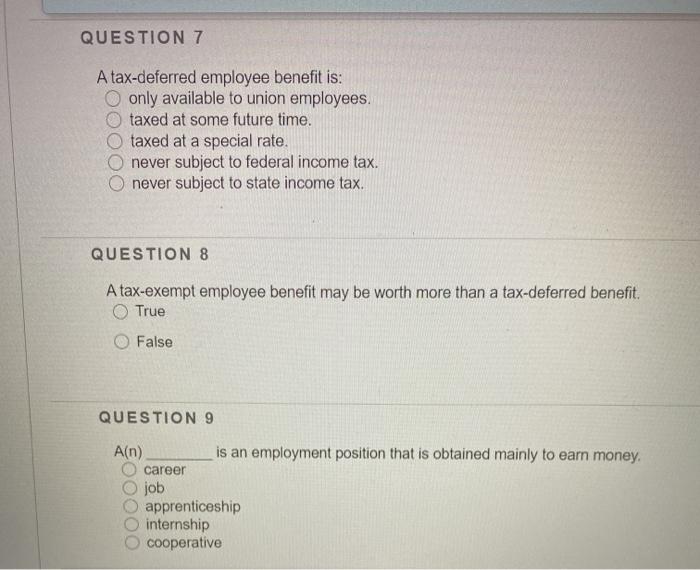

Solved QUESTION 7 A taxdeferred employee benefit is only

As per chegg policy, i can answer first four parts. Distributions from the plan are taxed as. As described, defined benefit plans provide significant tax savings to both employers and employees.

TaxDeferred Investments Definition, Types, Pros, and Cons

As described, defined benefit plans provide significant tax savings to both employers and employees. Distributions from the plan are taxed as. As per chegg policy, i can answer first four parts.

What Is A TaxDeferred Retirement Plan? (2024)

As per chegg policy, i can answer first four parts. Distributions from the plan are taxed as. As described, defined benefit plans provide significant tax savings to both employers and employees.

Deferred Tax Asset Calculation Example Balance Sheet Verkanarobtowner

As per chegg policy, i can answer first four parts. Distributions from the plan are taxed as. As described, defined benefit plans provide significant tax savings to both employers and employees.

Deferred Tax Asset Create and Calculate Deffered Tax in Accounting

As described, defined benefit plans provide significant tax savings to both employers and employees. Distributions from the plan are taxed as. As per chegg policy, i can answer first four parts.

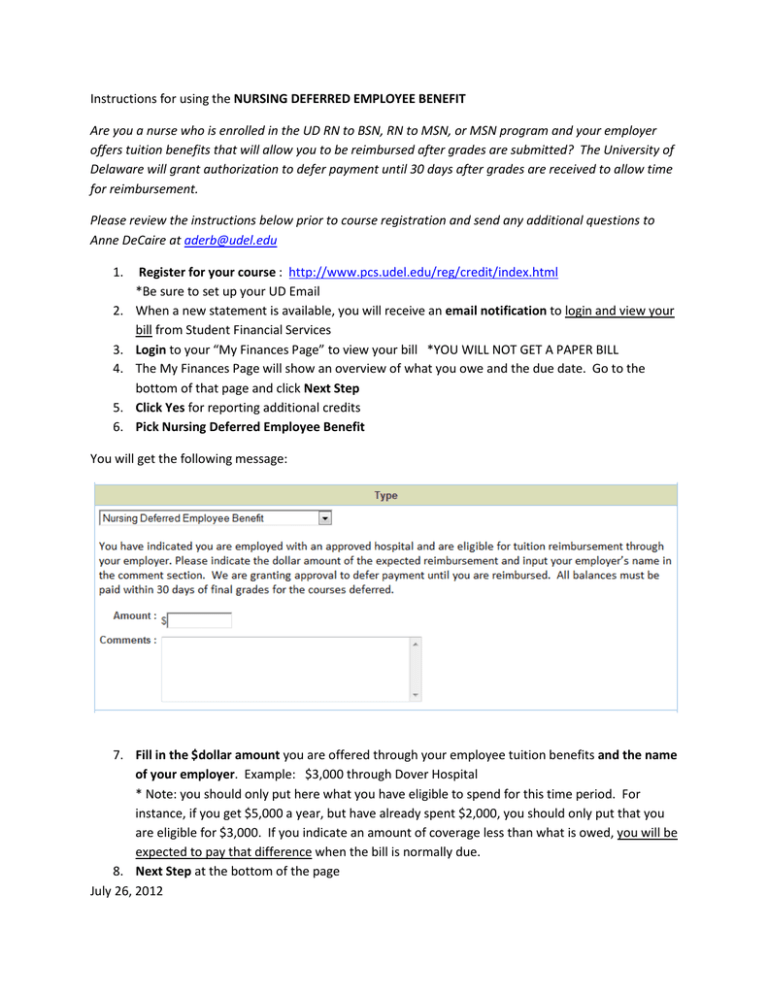

NURSING DEFERRED EMPLOYEE BENEFIT

Distributions from the plan are taxed as. As per chegg policy, i can answer first four parts. As described, defined benefit plans provide significant tax savings to both employers and employees.

As Per Chegg Policy, I Can Answer First Four Parts.

As described, defined benefit plans provide significant tax savings to both employers and employees. Distributions from the plan are taxed as.