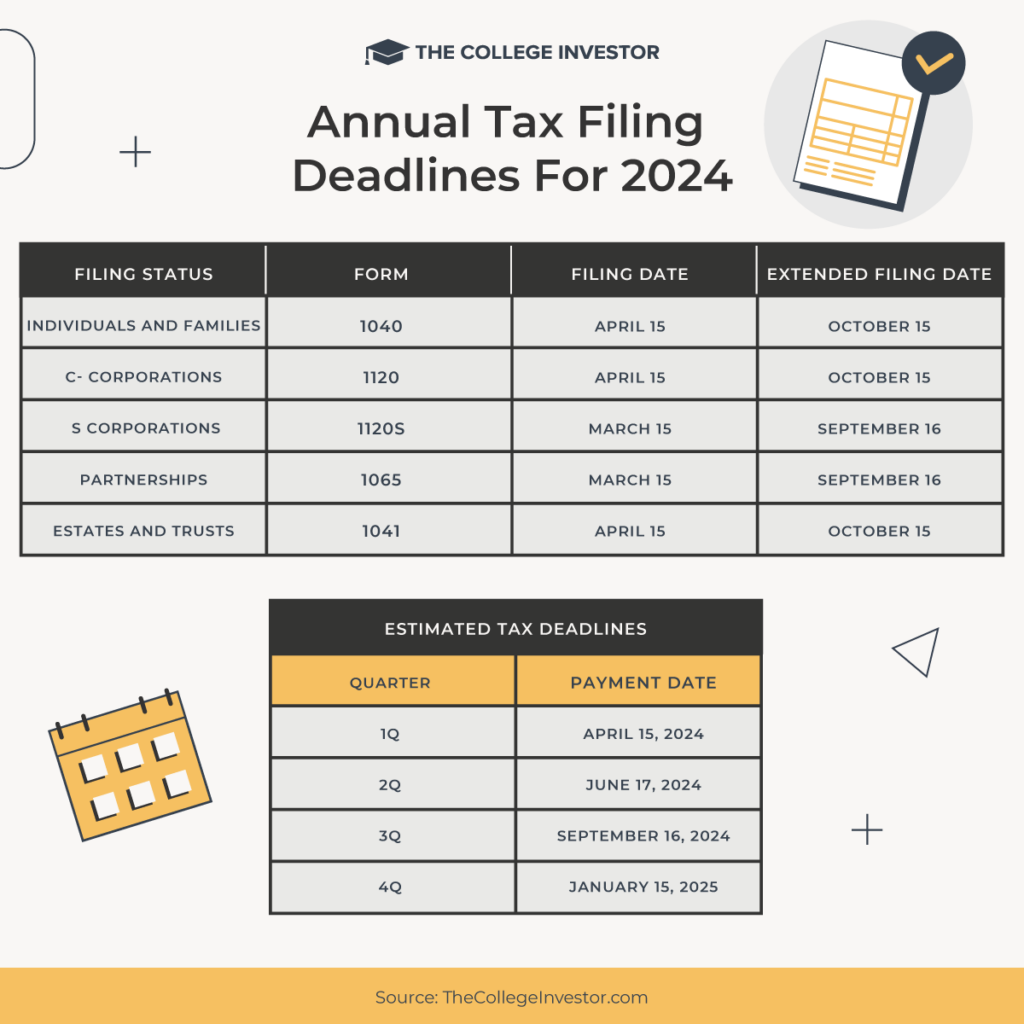

2024 Tax Calendar - Heavy highway vehicle use tax. The calendar gives specific due dates for filing tax forms, paying taxes, and taking other. However, if you have a keogh or sep and you get a filing extension to october 15, 2025, you can wait until then to put 2024 money. Quarterly taxes due for fourth quarter january 24, 2024. This tax calendar has the due dates for 2024 that most taxpayers will need. This free, easy to use federal tax calendar for 2024. File form 730 and pay the tax on wagers accepted during november 2023. Employers and persons who pay excise taxes should also use the. To help you make sure you don’t miss any important 2024 tax deadlines, we’ve provided this summary of when various tax.

The calendar gives specific due dates for filing tax forms, paying taxes, and taking other. Employers and persons who pay excise taxes should also use the. To help you make sure you don’t miss any important 2024 tax deadlines, we’ve provided this summary of when various tax. Heavy highway vehicle use tax. This tax calendar has the due dates for 2024 that most taxpayers will need. Quarterly taxes due for fourth quarter january 24, 2024. File form 730 and pay the tax on wagers accepted during november 2023. However, if you have a keogh or sep and you get a filing extension to october 15, 2025, you can wait until then to put 2024 money. This free, easy to use federal tax calendar for 2024.

However, if you have a keogh or sep and you get a filing extension to october 15, 2025, you can wait until then to put 2024 money. Heavy highway vehicle use tax. The calendar gives specific due dates for filing tax forms, paying taxes, and taking other. To help you make sure you don’t miss any important 2024 tax deadlines, we’ve provided this summary of when various tax. This free, easy to use federal tax calendar for 2024. File form 730 and pay the tax on wagers accepted during november 2023. Quarterly taxes due for fourth quarter january 24, 2024. Employers and persons who pay excise taxes should also use the. This tax calendar has the due dates for 2024 that most taxpayers will need.

Tax Free Week 2024 Dates Agata Ariella

Employers and persons who pay excise taxes should also use the. This free, easy to use federal tax calendar for 2024. Heavy highway vehicle use tax. This tax calendar has the due dates for 2024 that most taxpayers will need. Quarterly taxes due for fourth quarter january 24, 2024.

New Tax Info For 2024 Calendar Eda Josefina

However, if you have a keogh or sep and you get a filing extension to october 15, 2025, you can wait until then to put 2024 money. Employers and persons who pay excise taxes should also use the. This free, easy to use federal tax calendar for 2024. Quarterly taxes due for fourth quarter january 24, 2024. To help you.

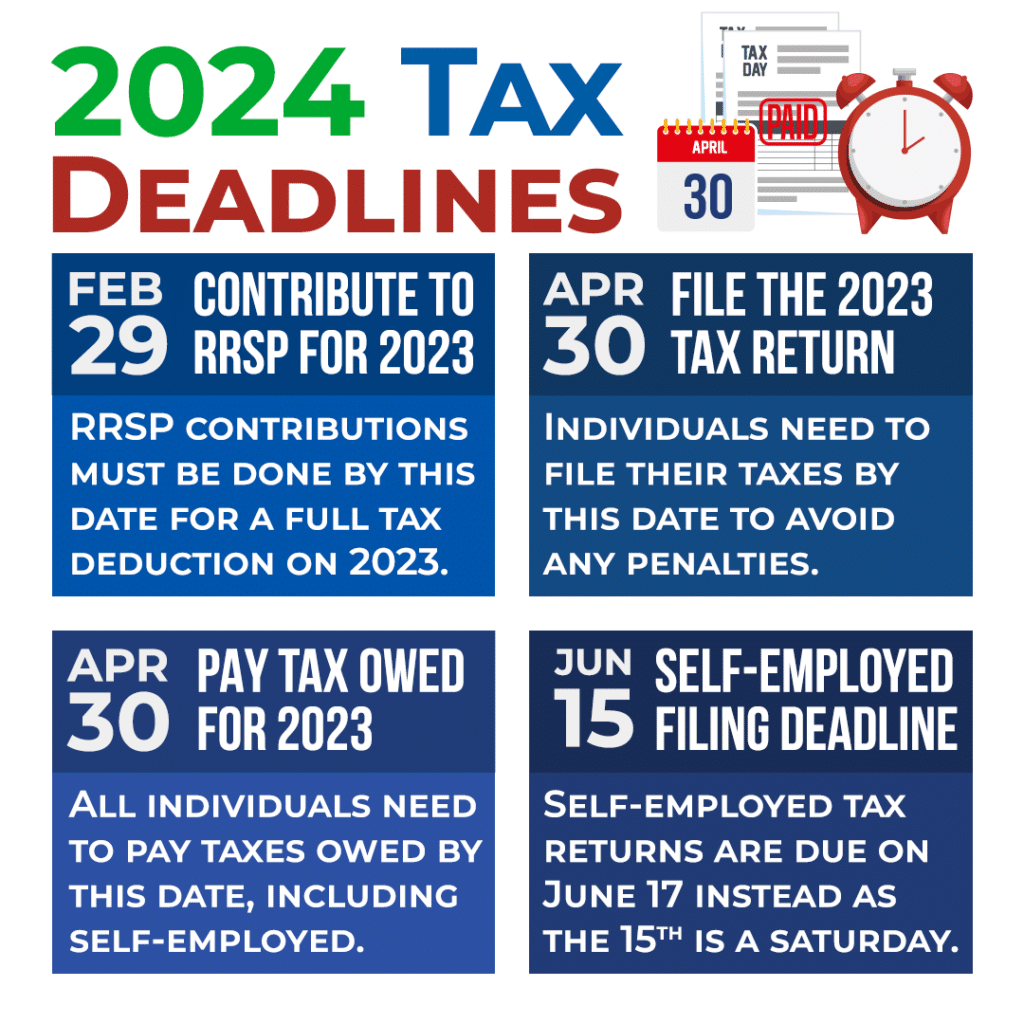

2024 Tax Calendar Important Deadlines SVA CPA

File form 730 and pay the tax on wagers accepted during november 2023. However, if you have a keogh or sep and you get a filing extension to october 15, 2025, you can wait until then to put 2024 money. Heavy highway vehicle use tax. Employers and persons who pay excise taxes should also use the. This free, easy to.

2024 Federal Tax Calendar (image cover) Lifetime Paradigm

The calendar gives specific due dates for filing tax forms, paying taxes, and taking other. To help you make sure you don’t miss any important 2024 tax deadlines, we’ve provided this summary of when various tax. Quarterly taxes due for fourth quarter january 24, 2024. This free, easy to use federal tax calendar for 2024. Heavy highway vehicle use tax.

Irs Calendar 2024 Audra Candide

To help you make sure you don’t miss any important 2024 tax deadlines, we’ve provided this summary of when various tax. File form 730 and pay the tax on wagers accepted during november 2023. This tax calendar has the due dates for 2024 that most taxpayers will need. The calendar gives specific due dates for filing tax forms, paying taxes,.

Tax Calculator 20242024 Sella Sophronia

This free, easy to use federal tax calendar for 2024. Employers and persons who pay excise taxes should also use the. File form 730 and pay the tax on wagers accepted during november 2023. Heavy highway vehicle use tax. Quarterly taxes due for fourth quarter january 24, 2024.

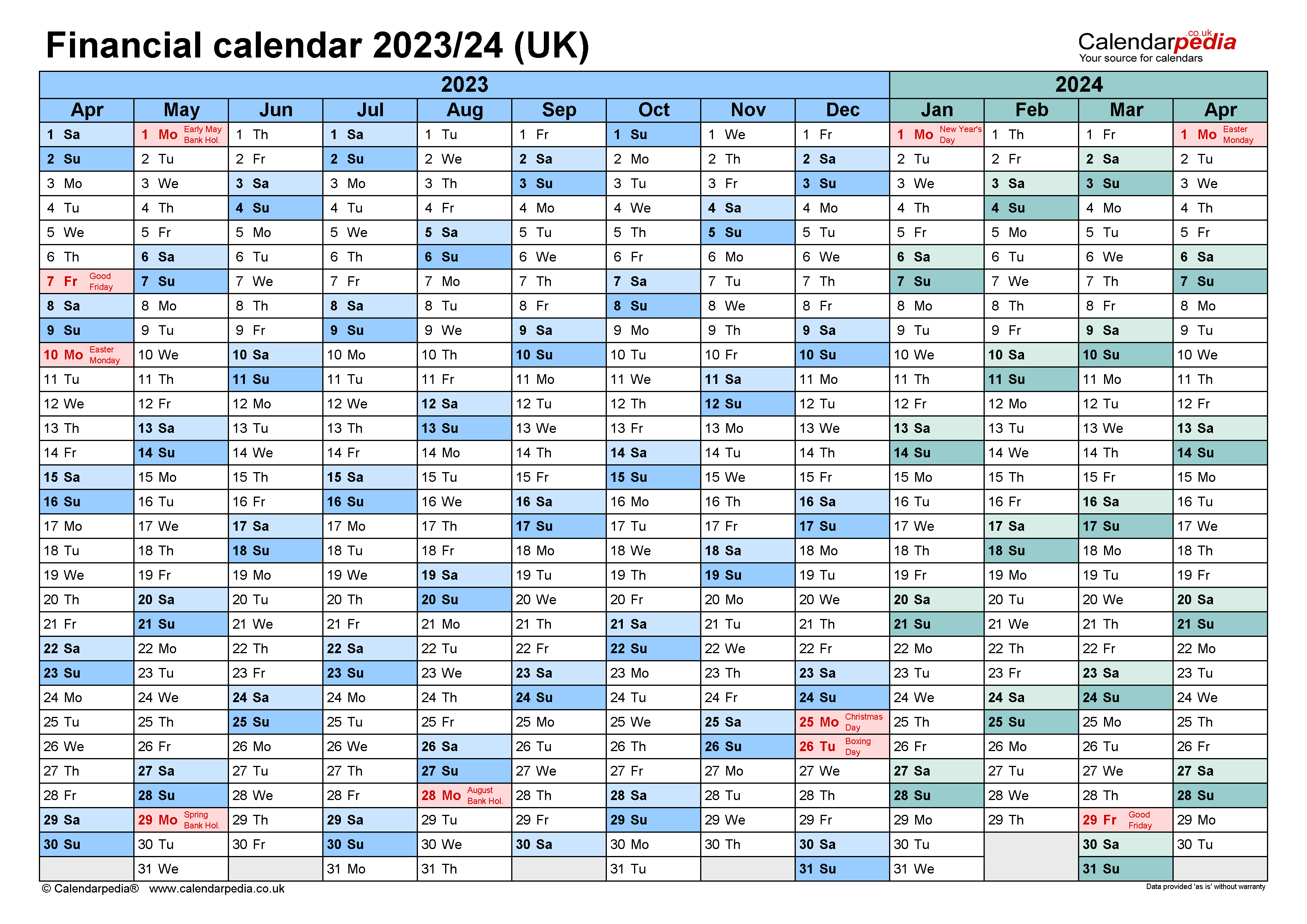

Tax Calendar 202425 Junia Beatrix

Heavy highway vehicle use tax. This free, easy to use federal tax calendar for 2024. This tax calendar has the due dates for 2024 that most taxpayers will need. However, if you have a keogh or sep and you get a filing extension to october 15, 2025, you can wait until then to put 2024 money. The calendar gives specific.

2024 tax calendar Miller Kaplan

However, if you have a keogh or sep and you get a filing extension to october 15, 2025, you can wait until then to put 2024 money. The calendar gives specific due dates for filing tax forms, paying taxes, and taking other. To help you make sure you don’t miss any important 2024 tax deadlines, we’ve provided this summary of.

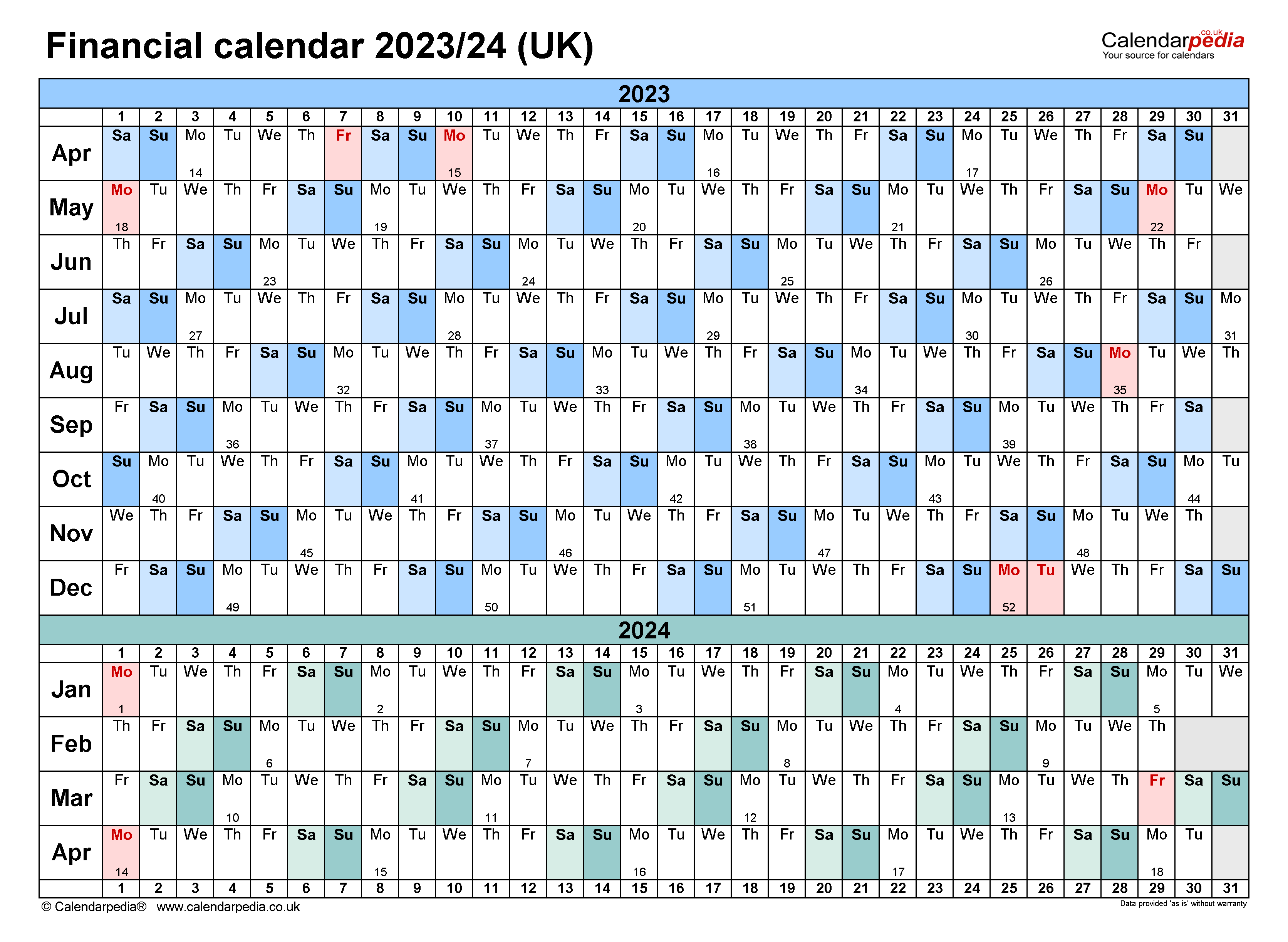

2024 Full Calendar Pdf Form Irs Adele Antonie

Heavy highway vehicle use tax. This free, easy to use federal tax calendar for 2024. However, if you have a keogh or sep and you get a filing extension to october 15, 2025, you can wait until then to put 2024 money. To help you make sure you don’t miss any important 2024 tax deadlines, we’ve provided this summary of.

2024 Tax Deadline Calendar Lila Shelba

To help you make sure you don’t miss any important 2024 tax deadlines, we’ve provided this summary of when various tax. File form 730 and pay the tax on wagers accepted during november 2023. Heavy highway vehicle use tax. Quarterly taxes due for fourth quarter january 24, 2024. This tax calendar has the due dates for 2024 that most taxpayers.

Employers And Persons Who Pay Excise Taxes Should Also Use The.

File form 730 and pay the tax on wagers accepted during november 2023. This tax calendar has the due dates for 2024 that most taxpayers will need. This free, easy to use federal tax calendar for 2024. Heavy highway vehicle use tax.

Quarterly Taxes Due For Fourth Quarter January 24, 2024.

To help you make sure you don’t miss any important 2024 tax deadlines, we’ve provided this summary of when various tax. However, if you have a keogh or sep and you get a filing extension to october 15, 2025, you can wait until then to put 2024 money. The calendar gives specific due dates for filing tax forms, paying taxes, and taking other.